Received 14 February 2023; Revised 29 April 2023; Accepted 23 May 2023.

This is an open access paper under the CC BY license (https://creativecommons.org/licenses/by/4.0/legalcode).

Kesara Wimal, MBA, MSc in Advanced Software Engineering, School of Computer Science and Engineering, University of Westminster, London W1B 2HW, United Kingdom, e-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Selvaratnam Ajendra, MBA, ACMA, CGMA, Lecturer, Global Banking School (GBS), Greenford UB6 0HE, United Kingdom, e-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Abstract

PURPOSE: The main purpose of this qualitative study was to explore tech start-up failures in Sri Lanka to emerge themes that explain the critical factors that are impacting failures of Sri Lankan tech start-ups and also to identify recommendations that could help evade those factors. The paper also presents the finding to enrich tech entrepreneurs to build their strategies with an understanding of factors that leads to failure and to make well-educated decisions. METHODOLOGY: The study is based on a qualitative research approach that helps to present findings in a theoretical way. A phenomenological analysis has been used to identify, understand, and analyze the phenomena of tech start-up failures. Twelve start-up leaders participated in this study and shared their lived experiences of tech start-up failures in Sri Lanka. Interviews were conducted with them based on twelve interview questions and twelve core themes emerged based on the participants’ lived experiences. In analyzing data, the modified Van Kaam approach was used, utilizing a seven-step framework that considers the structural and textual aspects of experiences, as well as the perceptual characteristics of the phenomenon. FINDINGS: The themes answered the key research question of the study: What are the critical factors that are impacting on failures of tech start-ups in Sri Lanka? The cause of tech start-up failures according to the current study varied including, financial uncertainty, no market research, no product–market fit, paranoid behaviors of innovators, lack of timely response to changing conditions, and location of the venture. IMPLICATIONS: The paper concisely presents twelve critical reasons for tech start-up failures. The results of the research will enable Sri Lankan tech start-ups to identify key factors of failure for the growth of their surviving strategies. Identifying secret obstacles in the industry helps entrepreneurs prepare for pitfalls and provides guidelines for policymakers to make informed choices when implementing national policies. More importantly, it has been discovered that the major areas that require more attention are leadership, funding, marketing, and innovation. Finally, four groups of recommendations have been discussed under financing, market research, leadership, and inventors. ORIGINALITY AND VALUE: The comparison of the current study themes with the findings of related studies is inconclusive because the literature on tech start-up failures in other countries and in Sri Lanka is minimal. Some of the themes align with the findings of research conducted in other countries, although there were some themes that were explored uniquely.

Keywords: entrepreneurship, tech entrepreneur, start-up failure, critical success factors, software start-up, survival strategies, technology start-up

INTRODUCTION

As a main critical driver of social and economic growth, entrepreneurship can be identified. As a result, policymakers are paying attention to entrepreneurs and new ventures. Entrepreneurs are key drivers of any kind of economy, not only because they are generating jobs but also because they create innovations (Acs, Audretsch, & Lehmann, 2013). Start-ups are coming out as the main outcome of entrepreneurship activities. Basically, a start-up is a young company set up to develop a new product or service and bring one or more entrepreneurs to the market. The traditional start-up tends to be a shoestring activity because of its essence, most entrepreneurs raise their initial capital from themselves or their friends and families (Roberts, 1990). Start-ups face high volatility and high rates of failure, but a minority of them remains effective and impactful. By providing an effective and efficient solution, most start-up founders aim to address a big pain of the current society, and most recent start-ups combine technology into their solutions (Kohler, 2016). The initial start-up phase is somewhat traditional, and they begin to develop a minimum viable product (MVP) after performing interviews and validating market requirements. The life cycle of a typical start-up is expected to be three years or a bit longer, so a sustained effort is needed while minimizing uncertainty (Birley, 1996).

There is another key term that is always coupled with the term “start-up” which is “start-up failure”. The term is clearly pessimistic but it’s important to explore why start-ups are failing because only a few scientific studies attempt to address the characteristics of failure, particularly in the early stage (Giardino, Wang, & Abrahamsson, 2014). Some eight out of ten new companies have struggled in their first three years. Nine out of ten start-ups that are venture-backed fail to yield positive returns. 99% of the pitches they see are turned down by venture capitalists (Feinleib, 2011). Most of the time start-up founders are following the glory instead of the market, which is why they are blind to understanding the hidden obstacles. Most software product businesses fail to make a worthwhile return on their financers, founders, and employees’ investments. Failures in distribution, marketing, and delivery implementation are widely known, but failures in product creation are less evident, while in some cases, it can be the main reason (Crowne, 2002).

Tech start-ups leverage innovation and entrepreneurial creativity to bring new ideas to market. They are typically founded by individuals with innovative ideas, seeking to establish new businesses (Kalyanasundaram, Ramachandrula, & Mungila Hillemane, 2021). Sri Lanka’s ICT/BPM industry led the country’s service exports in 2019, with tech start-ups playing a significant role in contributing to the national economy and societal well-being. Given their crucial impact on the economy, academics and policymakers should focus on improving the conditions for tech start-ups in Sri Lanka (Samarasinghe, Sandanayake, & Samarasinghe, 2021).

The primary objective of this research is to identify, understand, and analyze the critical factors that are impacting the failures of tech start-ups in the Sri Lankan context, as well as to give a brief understanding of how to avoid such factors for future start-ups: 1) Identify the critical factors for the failures of tech start-ups in Sri Lanka. 2) Understand the lived experiences of technology start-up leaders with the causes of technology start-up failure in Sri Lanka. 3) Present the study findings to support entrepreneurs to build tech companies by focusing on success and diminishing failures.

Understanding the essence of small business failure has been an ongoing activity of researchers. The study shows that the causes of failure have changed over time (Simmons, 2007). Previous literature suggested the presence of correlations in factors affecting small business success or failure, irrespective of the time that the small business operated. Kline and Perry noticed that management abilities led to the success of small companies (as cited in Simmons, 2007).

Stinchcombe (1965) claimed that small ventures have fewer resources than more mature companies and less leadership experience managing the firm. Between 1991 and 2000, an empirical study of 11,259 technology start-ups found that 36% of technology start-ups survived the last four years, but only 21.9% survived the last five years (Song et al., 2008), resulting in severe losses to stakeholders. According to the U.S. Small Business Administration (2006), around 550,000 small businesses close annually in the United States. Collins (2005) noted that there was a correlation between sound leadership characteristics and the performance of the organization. Small business leaders face leadership challenges while launching a new business first and then expanding it (Mellahi & Wilkinson, 2004). Small business failure analysis has traditionally concentrated on external and internal causes (Rasheed, 2005). Government controls, labor competition, and the decrease in demand were external factors, while financial capital and leadership were internal factors (Mellahi & Wilkinson, 2004). The company life cycle often affects variables that could affect the understanding of leaders during the various stages of the growth of an organization (Wheatley, 2006).

Prior research on the underlying factors contributing to the failure of small businesses has yielded inconclusive and context-dependent results, as indicated by extant literature. The examination of small business failures in Uganda (Tushabomwe-Kazooba, 2006) reveals that politics and taxes are prominent causal factors, whereas two separate studies on Indian (Goswami, Murti, & Dwivedi, 2023) and South African (Fatoki, 2014) start-ups fail to mention these aspects. The objective of the current study was to explore the variables affecting the failure of technology start-ups. The findings of the current study might add to previous research by enhancing the knowledge of the causes of technology start-up failure in Sri Lanka.

This study aims to critically analyze the factors contributing to technology start-up failures in Sri Lanka through an examination of the lived experiences and perspectives of technology start-up leaders, with a goal of supporting entrepreneurs in building successful tech companies by emphasizing crucial factors. The following research questions (RQ) are:

RQ1) What are the critical factors for the failures of tech start-ups in Sri Lanka?

RQ2) What are the lived experiences of technology start-up leaders with the

causes of technology start-up failure in Sri Lanka?

RQ3) How this study can support entrepreneurs to build tech companies by

focusing on the critical factors and diminishing failures?

LITERATURE REVIEW

The word entrepreneur is derived from the term “entreprendre” in French, meaning “to undertake.” The basic definition of entrepreneurship doesn’t align with current entrepreneurs’ mindset, and the modern concept also focuses on solving significant problems to enhance the world. Like creating social change or creating an innovative product that challenges the status quo on how we live our lives every day (Frese & Gielnik, 2014). The characteristic of an entrepreneur and a start-up founder is not always similar. For an entrepreneur, it is important to get paid for the effort or money he has invested. But start-up founders often do not think at first about the process of sale because they want to produce greater income in the future (Sethi, 2014).

Start-up founders are often called visionaries because of their greater vision to be successful while building something impactful to humanity. Working on technology for a start-up, or taking venture capital, or getting some sort of “exit” is also not relevant. The only important thing is progress (Graham, 2012). A start-up is “a human institution designed to deliver a new product or service under conditions of extreme uncertainty” as Eric Ries said in The Lean Startup (2011).

Start-up tech companies face a very competitive market. They must offer highly creative products in the shortest time possible. Resources are limited and the time to enter the market is short, so having the right specifications is extremely essential. Nonetheless, software specifications are generally not transparent and start-ups are struggling to understand what they should build (Melegati & Goldman, 2016). Tech start-ups, operating under limited funding and facing high uncertainty, often face immense pressure. Consequently, they tend to prioritize speed to market over long-term codebase health, leading to the accumulation of technical debt (Besker et al., 2018).

Definition of start-up failure

“It’s fine to celebrate success, but it is more important to heed the lessons of failure.” (Bill Gates, n.d.) Although 50 million new ventures are launched worldwide every year, according to the European Association of Business Angels, 90% of them fail (Bednár & Tarišková, 2017). The process may have already been undertaken by many of those with the greatest entrepreneurial skills, leaving a disproportionate number of lower potential entrepreneurs next in line (Kuntze & Matulich, 2016). Some studies introduce starting a start-up as a game because of the uncertainty and required continuous effort and also most of the scholars are saying failures are the pathway to success. As start-up failure has been seen both positively (e.g., McGrath, 1999) and negatively (e.g., Dickinson, 1981). Although monetary and emotional costs express the negative effects of failure, their positive effects are less noticeable, being related to learning, experience, and other cognitive constructs (Mitchell, Mitchell, & Smith, 2004). For at least two decades, start-up failure has been a subject of research. It has been examined at many stages of analysis in one context or another, in firms (Azoulay & Shane, 2001), in organizational populations (Hannan & Freeman, 1989), in individuals (Shepherd, 2003), and in the economy (McGrath, 1999). It has been correlated with business grief (Shepherd, 2003), learning (Minniti & Bygrave, 2001), risk and reward (McGrath, 1999), and various other socio-economic phenomena (e.g., Begley & Tan, 2001). In order to gain a deeper comprehension of the factors contributing to success or failure in businesses, several types of research are available (Gaskill, Van Auken, & Manning 1993). Nevertheless, there remain numerous unresolved questions that necessitate further exploration. When it comes to the failures of start-up ventures, previous studies have failed to provide a comprehensive or cohesive explanation (Lussier, 1996).

This study is focusing on not only start-ups but also on tech start-ups. More recent research has focused on integrating the methods of Design Thinking (DT), Lean Startup, and Agile to create and scale new products in order to specifically reduce tech start-up failures (de Paula & Araújo, 2016). In 2008, Eric Ries explored and introduced two explanations for the failures of most tech start-ups when he proposed his approach called Lean Startup Methodology, which aimed to manage high-tech start-up enterprises.

- Application of conventional management business tools, assessment of performance, construction methods, and industry inquiries. For start-ups that act in conditions of uncertainty, these traditional instruments are almost useless.

- Exactly the opposite reason: entrepreneurs begin to ignore the above instruments and all other management techniques, organizing a kind of market chaos under the “Just do it” flag, seeing that all this does not work.

Noam Wasserman’s The Founder’s Dilemmas (2012) emphasizes that early, relatively easy, and seemingly short-term decisions can have important long-term consequences. Hence the need to make these choices rationally, building on the knowledge of others. In the term call start-ups, the susceptible to the start-ups’ failures are created. So to prevent these futures, it is more important to consider precise explanations for start-up failures.

Causes of start-up failure

Fatoki (2014) conducted a comprehensive literature analysis on the factors contributing to the failure of new small businesses in South Africa. The findings underscored several key challenges faced by these ventures including the absence of an efficient logistics chain, exorbitant distribution costs, intense competition, rising operational expenses, and inadequate access to funding.

A case study based empirical study conducted an investigation into the reasons behind the failure of small businesses in Uganda and identified various factors contributing to the downfall of these businesses, including the absence of business plans, excessive taxes, power outages, insufficient capital, unfavorable market conditions, exorbitant rental fees, and incorrect pricing strategies (Tushabomwe-Kazooba, 2006).

Goswami, Murti, and Dwivedi (2023) explored the reasons behind the failure of Indian start-ups by conducting a narrative analysis of prominent business stakeholders. Their findings revealed that a lack of capital or insufficient funds, along with an ineffective sales and marketing strategy, emerged as the primary factors contributing to the failure of start-ups in India.

Kalyanasundaram (2018) examined start-up failures in Bangalore and discovered key factors distinguishing failed start-ups from successful ones, including the time taken to reach a minimum viable product, revenue generation, founders’ complementary skills, their personality traits, financial independence mindset, and openness to mentorship during critical stages.

Finance related failures. Successful start-ups distinguished themselves by monetizing their ideas and generating revenue within six months of their minimum viable product (MVP) launch, reinvesting profits into product enhancement, and avoiding reliance on investors (Kalyanasundaram, 2018). Investors often cause start-up failures, and while some entrepreneurs benefit from them, most cofounders resent their interference. They complain about being pressured to follow the investors’ direction, including forced pivots and unwanted matchmaking (Kalyanasundaram, Ramachandrula, & Mungila, 2021).

Leadership failures. Mistakes in management or leadership contribute significantly to the downfall of small business failure. Several prominent errors in leadership result in business failures. These include embarking on entrepreneurship for inappropriate motives, underestimating the time commitment required for business success, facing pressures from the family in terms of time and financial resources, lacking awareness of the market, failing to exercise financial responsibility, and lacking a well-defined focus (Fatoki, 2014). One of the main reasons small firms fail is a lack of effective management in the beginning (Tushabomwe-Kazooba, 2006).

Less product innovation related failures. Innovation plays a pivotal role in shaping the fate of start-ups, thus leading to the belief that the lower the innovativeness the smaller the performance (Aminova & Marchi, 2021). The primary cause behind the failure of start-ups is often attributed to their inability to achieve a suitable alignment between their product and market demands. A strong emphasis on understanding and meeting the specific needs of the target audience is crucial in establishing a successful product–market fit and increasing the chances of start-up prosperity (Cantamessa, Gatteschi, Perboli, & Rosano, 2018).

Lack of knowledge and experience-related failures. Start-up companies have a higher likelihood of failing when the team of co-founders lacks the necessary complementary skills, which is made worse by their limited collective experience. When entrepreneurs embark on a new venture without the required expertise or a balanced set of skills among them, it becomes a recipe for a disastrous outcome (Kalyanasundaram, Ramachandrula, & Mungila, 2021). Start-ups with academically qualified founders and a high percentage of graduate workers are more likely to innovate and perform better, as the combination of founder knowledge and workforce academic experience leads to greater identification and exploitation of new opportunities, changing the market and increasing start-up performance (Aminova & Marchi, 2021).

Start-up ecosystem in Sri Lanka

Tech start-ups mainly doing software development are one of the largest contributors to the export economy in Sri Lanka. Sri Lankan engineers are at the forefront of innovation, from electric sports cars, eBay’s middleware, to powering one of the world’s most successful stock exchanges. In the 2019 edition of the World Bank’s Ease of Doing Business Index ranking among the top 100 (13th in Asia) among 190 nations, Sri Lanka rose 11 positions. Sri Lanka’s ICT industry can increasingly concentrate on value-added ICT products that include the Internet of Things (IoT), Artificial Intelligence (AI), and Big Data. In addition, physical goods that make use of 3D printers, laser cutters, and CNC routers should be the focus of the Sri Lankan ICT industry (Fernando, 2018). Priorities for Sri Lanka’s accession to the WTO Information Technology Agreement should be to enhance its ICT and English language skills standards, increase its investment in digital communication through public Wi-Fi and zero-rated services, and develop versatile and consistent regulations based on the functionality of digital products and services. More generally, the main elements of the path forward are political stability and constructive public policy (De Zylva & Wignaraja, 2018). The level of taxation, which is a factor in the legal climate, is seen as an enormous obstacle, especially when a company is operating on a comparatively smaller scale. The environmental effect on entrepreneurs in various industries was examined and it could be found that most entrepreneurs were negatively impacted by the overall atmosphere (Gamakumara, 2008).

The 2019 ICTA Workforce Report shows that in 2018, revenues from exports of telecommunications, computer, and information services (according to Central Bank of Sri Lanka Reports) rose to US$ 995 million. From US$ 920 million in 2017, this is a 7.5% increase. US$ 848 million (85% of total earnings in 2018 was raised jointly by ICT and BPM firms, while telecommunications contributed US$ 147 million (15%). Over the past five years, the sector has expanded by 120%, becoming the economy’s fifth-largest source of foreign earnings (Abeywickrama, Degamboda, & Manchanayake, 2020). In its strategic report in December 2016, the Sri Lanka Association for Software and Services Companies (SLASSCOM) set out the industry’s objectives to be achieved by 2022, such as US$ 5 trillion in export revenue, 200,000 people employed in the industry, and 1,000 new start-ups in this sector. This was revised in 2020 to reach US$ 3 billion and 300,000 jobs by 2025, in line with the vision of the new president of Sri Lanka. It is also worth noting that the goal has been lowered from US$ 5 billion (to be achieved by 2022) to US$ 3 billion (to be achieved by 2025). The argument itself reflects the difficulties faced by the industry in growing its revenue.

As there are no figures on undertakings that have failed in their attempts, it is understood that the majority of new technology undertakings do not make their first year of operation because of several different reasons (Damodaran, 2009). Knowing what the primary cause of failure was and what steps to take to make it a success would be helpful for potential entrepreneurs in the Sri Lankan tech start-ups’ echo system.

Research gap

The main focus of this study is to explore the key factors contributing to the failures of technology start-ups in Sri Lanka. A thorough examination of existing literature has uncovered significant gaps in research related to this topic. While numerous studies have explored the reasons behind tech start-up failures in various countries, limited research has been conducted on a phenomenological exploration based on the lived experiences of technology start-up leaders. The existing literature predominantly focuses on tech start-up failures in other geographical regions, and its applicability to the Sri Lankan context remains uncertain. There has been no significant study done in Sri Lanka about the unique challenges faced by Sri Lankan tech start-ups. This study has been undertaken against these backdrops.

METHODOLOGY

Design approach

The goal of this research is to identify the most significant failure factors that have impacted tech start-up failures. For this analysis, failed start-ups and their founders are considered the target population. The thesis focuses on a series of case studies of several entrepreneurs in Sri Lanka who created their start-ups and eventually failed them. The adopted strategy also incorporated the variables experienced by each and every creator. There are different kinds of methods of study that use various instruments for collecting data. Of these forms, the qualitative analysis method is used primarily for this study in order to present the results in a theoretical way.

The choice of the subject, problem, or area of interest, and the paradigm begins with a good research undertaking (Creswell, 1994). There are five types of qualitative approaches that can be used to perform a study, as this study focuses more on the phenomenon or occurrence (start-up failures) and the purpose of this study is to explain and understand how this event happens and how the phenomenon is evaluated. To perform this qualitative analysis, phenomenological research is used as the most suitable process. Interviews are usually performed with a group of people who have first-hand knowledge of the occurrence, circumstance, or experience. Two major questions are presented in the interviews (Moustakas, 1994): What have you encountered in terms of the phenomenon? What contexts or circumstances have usually affected your phenomenon experience (Creswell, 2013)? Unlike positivists, phenomenologists believe that the researcher cannot be excluded from his/her own premises and that the researcher should not pretend otherwise (Hammersley, 2000).

The researcher himself is a victim of start-up failure, so it is convenient for him to pursue the phenomenological analysis, rather than performing a survey, as he has a better understanding of the context. The aim of the phenomenological approach is to illuminate the particular, to define phenomena by how the actors in a situation interpret them. This usually translates into the collection and representation of deep data and experiences in the human sphere through inductive, observational approaches such as interviews, conversations, and participant observation from the viewpoint of the research participant(s) (Lester, 1999).

Sample selection

The main step for the selection of the participants was their willingness to share their perspectives and freely express their views. A second requirement was the possession of features applicable to the phenomenon being studied (Simmons, 2007). A non-probability sampling technique, purposeful sampling, involved selecting participants based on specific characteristics relevant to the research questions where the goal is to obtain rich and in-depth information about the phenomenon being studied. A sample size of 12 participants is sufficient in a phenomenological qualitative study to collect the data needed to explain the study phenomenon. A large sample size is not usually needed by researchers performing phenomenological research, since an increased number of respondents does not always lead to an improvement in research quality. Creswell (2005) suggested that “superficial perspectives” could result in a large number of cases (p. 207). According to the quality of the results, the final number of participants in a study may vary. Additional respondents would have been appropriate if no definitive patterns emerged from the interviews conducted with 12 participants. Participant interviews should continue till saturation occurs (Reaves, 2008). There were 12 participants interviewed in the current analysis. The sample was selected from among the failed technology start-ups in Sri Lanka under the following criteria:

- The company must have been founded between the years 2022 and 2010. Since the research looks at tech start-up companies, a ceiling was a prerequisite for the year that it was created. The specific industry is rapidly evolving, as stated in the literature review, and some factors affecting earlier start-ups can currently be decreased. Due to the lack of the minimum required numbers for a statistically reliable sample, the cap was considered up to the year 2010.

- By completing at least one good project, the organization has to represent the local software market or the foreign software market. Companies catering to the local market and having a mixed portfolio of markets (local and overseas) were considered for the study. The company could have launched a product that is already in the MVP stage of the product life cycle if the company is a product-based company.

Confidentiality and informed consent

The participants were asked to sign an informed consent form before beginning the interview, indicating that they understood the intent of the study and the possible risks of participating in the study. Unforeseen findings, pressures, and discomfort are included in the risks. Even if the research poses minimal risk to the participants, researchers should obtain informed consent from respondents (Creswell, 2005). The signatures of the participants indicated they were willingly involved in the study. The signatures also suggested that for the purpose of the analysis, the participants allowed the researcher to use the information they provided. Each participant received an oral explanation of the intent of the study and the reason for choosing the participant for the study at the beginning of the interview.

The identity of and the data obtained from the participants remained confidential. Participants received code numbers such as P1, P2, and P3, and the information they provided was coded to ensure that the content of the data collected remained confidential and could not be traced back to the interviewee or to a particular start-up (Walker, 2007). Participants were informed that, even in the written findings and recommendations, their involvement would remain anonymous throughout the study. The information and documentation obtained from interviewees remain in a safe and locked box, as Walker (2007) noted.

Data collection methods

Descriptive research should be carried out in order to recognize critical factors that influence the failures of Sri Lankan technology start-ups since the study focuses on qualitative research. In Gorden (1969), Measor (1985), Oakley (1981), Plummer (1983), and Spradley (1979), among others, interview approaches and problems are discussed.

Interviews are used as the primary source of data, and related researches conducted in various regions are known as the secondary source of data. These secondary data sources are used to explain, through the interviews performed, the data obtained. In our sampling, interviews are conducted with founders and CEOs of struggling tech companies. In order to understand what the most critical failing factors and the least critical failing factors are, the questionnaires were prepared to classify critical failure factors and the weight placed on each factor. The questionnaire consisted of three main sections, as described below.

Section 1: Information on companies

The objective of this section was to obtain qualitative data on the basis of the year of establishment, year of decline, local/overseas market portfolio, product portfolio, financial position, and business model. In terms of freedom of speech, the name of the organization or any other confidential information was not included in the questionnaire.

Section 2: Info on the founder/s

The real goal of this segment is to understand the founder’s history, as the founder is the key individual influencing the growth of the start-up, and to consider what the lack of knowledge or comprehension of the viewpoint of the creator is. Here the academic credentials of the founder, experience in the relevant business market, leadership skills, personality, and motivation for business success were addressed.

Section 3: Factors that have an effect on failures

This section focuses on obtaining the knowledge required to identify the most significant factors of failure that affect tech start-ups. Any variables found by the secondary sources of data are also included and given the opportunity to explain their own experience before that. A small Likert scale was presented with them based on the responses to determine the effect of each element. In addition, due to the importance of evaluating the most significant factors, they were asked to order the factors.

The questionnaire targeted the owners, founders, and CEOs of the sample firms. Via personal contacts, cold phone calls, and sending emails, connections to these people were acquired. To improve the quality of the reviews, a number of interviews were performed in person.

Data collection procedure

The basis for gathering data for the analysis was online meetings. The data collected from the participants revealed their experiences related to variables that affect the failure of start-ups in technology. Data were divided into three categories: demographics of interviewees, lived experience of technology start-up failure, and start-up survival recommendations.

To maintain confidentiality and to analyze the data, the information obtained from the interviews was coded. A thorough analysis of the data offered insights into the data obtained and a sense of it. Statements that were not important to the research question were excluded from the database. Key statements on the perspectives of participants were coded. The aim of coding was to make sense of the information gathered and to divide the data into logical segments. Then the segments were assessed for redundancy. It removed overlapping and redundant data. The data was added to the database at the end of each interview, and new themes were created. 12 participants were included in the interviewing process. While a saturation point was reached after 10 interviews, data obtained from all participants in the study included the interview process as well as the data collection and analysis. From the data review, 12 key themes emerged. Prior to the start of the actual data collection process, a pilot study consisting of two interviews was performed. Feedback on the relevance and consistency of the interview process and the responses are given by the two interviewers evaluating the interview questions. A couple of questions were merged and some were introduced to the list based on the input obtained from participants in the pilot study. The pilot study participants and the data obtained from them were not included in the actual results of the study. The twelve revised interview questions (IQ) are as follows:

IQ1: As a technology start-up leader in Sri Lanka, how would you characterize

your knowledge of the crucial factors affecting success in the company’s

early-stage life cycle?

IQ2: What factors in the first 2 years led to the failure of technology start-ups?

IQ3: According to your experience, why do most of the tech start-ups fail

more often?

IQ4: What characteristics of leadership have you considered to be crucial to

start-up success?

IQ5: What factors have you found to influence your ability to prevent start up

failure, other than leadership? As examples, please refer to variables

such as structure, culture, location, legal, marketing, networking, and

firm size.

IQ6: What were the critical characteristics of the market you approached and

how did the competition in the industry impact your failure?

IQ7: What was your understanding of pivot?

IQ8: What was the impact of investors and related activities on your start-up?

IQ9: How did the capital structure impact the start-up’s failure?

IQ10: What cultural factors have you found that impact the failure of

technology start-ups?

IQ11: What are the most important elements of a successful technology

start-up based on your experience?

IQ12: Are there any decisions you wish you had made differently when you

were running your start-up?

Most of the interviews were conducted online at a convenient time for both parties. Every interview conducted either online or physically was audio recorded in order to validate key points, and manual notes were also taken. Within 24 hours of their completion, the notes and recorded interviews were transcribed into a word document and checked for completeness and meaning. In the first interview, transcript coding allowed the identification of themes and made it easier during subsequent interviews to recognize emerging themes. Interviews persisted until no new themes appeared, with sample saturation being reached. Data analysis was completed using a modified van Kaam approach.

Data analysis method

In this analysis, the researcher chose to use a phenomenological approach to analyze the research issue. The main aim of using the phenomenological approach is to understand the common or mutual experiences of many people about a phenomenon in this specific case, it interviewed founders of tech start-ups who have failed in their start-up journey. It would be useful to understand these common experiences in order to improve practices or policies or develop a deeper understanding of the features of the phenomenon. Researchers must bracket their own experiences as much as possible to correctly describe how the phenomenon is viewed by the participants.

The process of data analysis uses the data obtained from interviews to identify important statements, expressions, or horizons and give them equal value as it pertains to the research questions. This process is called “horizontalization” according to Moustakas (1994). The researcher will then have to create clusters of meaning into themes from these essential statements. These similar statements and patterns are then used to explain what the participants have experienced (textural interpretation). They are also used to write a description of the background or environment that has influenced how the participants viewed the incident, called creative variation or structural description. From the structural and textural data, the investigator then writes a composite description that offers the “essence of the phenomenon.”

Reliability and validity

There is the potential for a person to incorporate prejudice into the examination in a qualitative sample. There is a need to use multiple data sources, given the negative effect that bias may have on the validity and reliability of the analysis. The use of multiple data sources is known as triangulation for qualitative analysis. The data was obtained in the current qualitative research through a literature review, interviews with study participants, and publicly accessible databases. The reliability of the collected data was improved by triangulation. The validity and reliability of the data were improved by comparing and combining the data obtained from the sources. To have a better understanding of the problem, the analysis included triangulation. Participants were requested to review the accuracy of their statements and corrections to reflect their comments in order to further ensure authenticity and reliability.

RESULTS

The aim of this qualitative phenomenological analysis is to examine the failures of technology start-ups in Sri Lanka and to recognize themes that could show the factors that are impacting start-up failures. Using a qualitative phenomenological study helps people to have a wider understanding of the subject that is being discussed under the given study (Moustakas, 1994). Creswell (2005) argued that when exploring issues that involve a deep understanding of the problem, a qualitative study is suitable. The data was gathered by conducting an in-depth interview with each participant using the van Kaam modified method (Moustakas, 1994). Interviews were conducted with 12 participants who identified their knowledge of the factors that are impacting the failures of tech start-ups in Sri Lanka.

The population for the study consisted of technology start-up founders/C-level executives in Sri Lanka who have experience in start-up failures. The key criterion for the selection of the participants was the possession of features related to the phenomenon under research, such as education and previous leadership roles in a Sri Lankan technology start-up. The second criterion was their ability to share their perspectives and freely express their views.

Data demographics

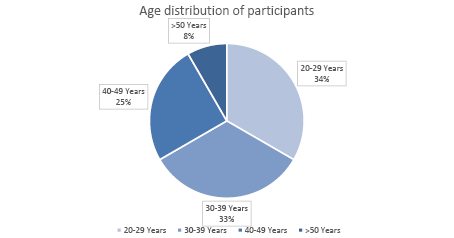

Out of 12 interviewees, 10 were male and 2 were female founders. The ages of participants ranged from 22 to 55. Figure 1 highlights the distribution of the ages between participated candidates.

Figure 1. Age distribution of participants

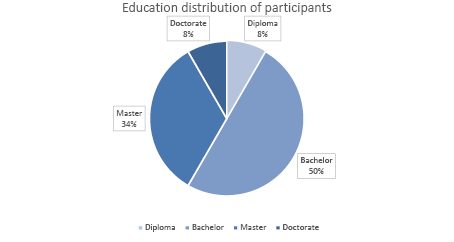

Most of the interviewees are holding a bachelor’s degree from a reputable university. The educational qualification of the participants is distributed from a diploma to a doctorate degree. Figure 2 shows the highest educational qualification achieved by the interviewees.

Figure 2. Education distribution of participants

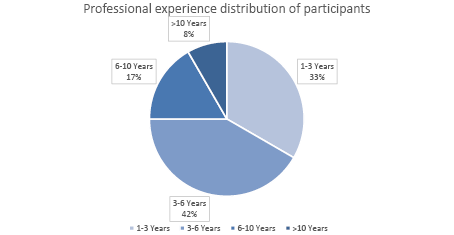

The sample was selected only from start-up founders, co-founders, or C-level executives. If the interviewee is not from the founding team that individual should engage in the business process from day one. The experience in the particular industry of the participants is distributed between 2 years to 15 years. Figure 3 indicates of professional experience gained by participants.

Figure 3. Professional experience distribution of participants.

The length of the interviews ranged from 31 minutes to 67 minutes. One meeting with P9 had to be conducted twice in order to get validation of some points which he presented in the first interview. The location of each start-up was varied, in order to cover all parts of Sri Lanka, so the participants were selected not only from Colombo but also from other districts of Sri Lanka.

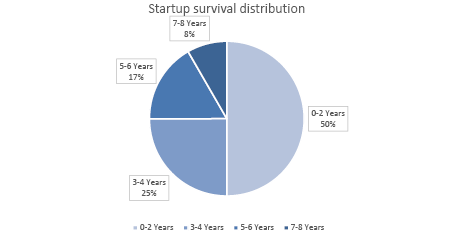

Figure 4 indicates the years of business survival, which varies between 2 years to 10 years. 50% of the 12 start-ups were unable to continue their process for more than 5 years.

Figure 4. Start-up survival distribution

Study findings

The study consisted of interviews with 12 participants who had held senior roles in a technology start-up in Sri Lanka. The interviews included 12 questions based on the interviewees’ lived experience of the phenomenon of technology start-up failure in Sri Lanka. The answers to questions from the interview were formed into patterns. Those patterns were reduced and clustered into 12 core themes using the modified van Kaam process (Moustakas, 1994).

Question 1 asked the following: As a technology start-up leader in Sri Lanka, how would you characterize your knowledge of the crucial factors affecting success in the company’s early-stage life cycle? Theme 1 was financial uncertainty, which had two sub-themes: running out of money and raising funds when necessary, not when feasible. Theme 2 was no market research and the sub-theme was reluctant to gather required market statistics. Question 1 focused on understanding the general perspective of start-up technology leaders on the factors that led in the first years of service to the failure of start-ups in Sri Lanka. Before moving through the more formal questions that follow in the interview, participants were asked to provide a broad perspective and to express their overall perceived experience. Without restricting themselves to particular aspects of start-up operations, the interviewees could apply to any factor they considered suitable.

Two main themes emerged from the answers obtained (see Table 1). First, financial uncertainty was a concern that 75% of participants posed. The lack of adequate funds slowed down the activities of R&D and marketing, creating a snowball effect. Potential investors have been hesitant to invest in a start-up that has not reached predefined targets. Forty-two percent of respondents indicated that start-up leaders should raise money whenever possible, instead of waiting until additional funding is required. Funds should be collected “whenever possible rather than when necessary,” according to P9. Seven participants indicated that it is the leader’s duty to ensure a positive cash flow. P5 argued that more funds should be raised by start-up managers than they believe are required in case of an emergency.

Second, 58% of interviewees said that being unfamiliar with market needs and demands could impede the success of start-ups. It is important to carefully analyze the needs and desires of the marketplace before releasing a new product. P5 said that revolutionary technologies or products need to meet specific consumer needs rather than the personal opinion of an inventor. P1 claimed that ever-changing industry conditions could lead to the production of products that have no market demand.

Table 1. New patterns emerging from Question 1

|

Pattern |

Participants |

No. of responses |

% of participants |

|

Financial uncertainty |

1,2,3,4,5,6,7,9,10,12 |

9 |

75 |

|

No market research |

1,2,3,5,6,7,9 |

7 |

58 |

|

Reluctant to gather required market statistics |

1,2,5,6,9 |

5 |

42 |

|

Raising funds when possible, not when needed |

2,5,6,7,9 |

5 |

42 |

|

Running out of cash |

5,6,10,12 |

4 |

33 |

Question 2 was as follows: What factors in the first 2 years led to the failure of technology start-ups? Theme 3 was no product–market fit (see Table 2). The aim of Question 2 was to understand the variables that affect the failure of technology start-ups in the midlife stage. Newstrom and Davis (2002) and Jones (2007) posited that the factors that influence success or failure change as the start-up moves from one stage to the next. Centralized power and decision-making characterize organizations during the early stage (Newstrom & Davis, 2002), whereas the midlife stage is characterized by leaders developing “value creation skills and competencies that allow them to acquire additional resources” (Jones, 2007, p. 312).

Ten participants (83%) indicated that not having a product–market fit is the earliest factor of failure. They mentioned that whenever the product is rejected by the market there is only a slight possibility that the start-up will survive. P12 stated that when they realized there was no product–market fit, it was too late, there were no resources left to pivot the idea. P6 argued that a creative product precedes a problem in certain situations, resulting in a successful product searching for a problem it might fix when the problem does not already exist, and in some scenarios, founders follow their gut instincts instead of statistics. P1 said that he had many ideas, but that his main concern was the feasibility to implement those ideas rather than the market requirements and which led him to failure.

Table 2. New patterns emerging from Question 2

|

Pattern |

Participants |

No. of responses |

% of participants |

|

No product–market fit |

1,3,4,5,6,7,9,10,11,12 |

10 |

83 |

Question 3 asked the following: According to your experience, why do most of the tech start-ups fail more often? Three themes emerged from the problem (see Table 3). Theme 4 was inventors, which had two subthemes: paranoid conduct and inability to share experience and knowledge. Theme 5 was a lack of timely response to environmental conditions, both internal and external. Geographic location was the 6th theme.

The purpose of Question 3 was to understand participants’ lived experience of the variables affecting start-up failure regardless of the stage of start-up life cycle level. Seventy-five percent of interviewees said inventors were a major factor that led to the failure of start-ups. Inventors were suspected by participants P2, P5, P6, P7, and P9 of being paranoid about the loss of their conventional organizational control. P6 and P10 noted that inventors are often unwilling to share with other members of the company information and knowledge and experience. Such a lack of collaboration hinders the progress of start-ups. P12 noted that inventors “are in love with their invention and that the pros and cons of their invention cannot be objective.”

Seven interviewees (58%) suggested that hesitation and slow reaction are major obstacles to the success of start-ups. Fast reaction to changing conditions is critical to start-up performance, according to P2, P3, P7, and P9. The skills and experience required in the early stage of life can vary from those required in the midlife period. As technologies are changing rapidly, technology start-ups are facing uncertainty and they must be up to date with the latest tech stacks, otherwise they get outcompeted, according to P5.

Six participants (50%) suggested that the position of the company was important for a start-up in technology. P2, P5, and P6 claimed that since Sri Lanka is a small island, most of the tech start-ups are highly dependent on global markets. There were barriers to start-up success due to the geographical gap between a start-up based in Sri Lanka and its overseas target markets. Start-ups located closer to the target market are more effective, according to P9.

Table 3. New patterns emerging from Question 3

|

Pattern |

Participants |

No. of responses |

% of participants |

|

Inventors |

2,3,4,5,6,7,8,9,10,12 |

9 |

75 |

|

Lack of timely response to changing conditions |

1,2,3,5,6,7,9 |

7 |

58 |

|

Location of venture |

1,2,5,6,9,10 |

6 |

50 |

|

Paranoid behavior of inventors |

2,5,6,7,9 |

5 |

42 |

|

Reluctance to sharing knowledge and experience |

5,6,10,12 |

4 |

33 |

Question 4 was as follows: What characteristics of leadership have you considered to be crucial to start-up success? Theme 7 emerged as a lack of diverse skills and experience, which are important for start-up success. Leadership skills, technical and business experience, and past failures were related sub-themes (see Table 4).

Participants classified the leadership features associated with the success of technology start-ups while addressing Question 4. Nine participants (75%) suggested that diverse business expertise and experience in management or leadership were critical to the success of start-ups. P10 argued that start-ups in technology are difficult organizations. Multidisciplinary expertise and experience in the areas of technology, marketing, finance, and operations should be accessible to the leader of such an organization.

Fifty-eight percent of the participants expressed that leadership skills are mandatory as a start-up leader, most of the time they are self-motivated, self-disciplinary, and they possess the power to motivate others and get the required contribution from them. Successful start-up leaders need the skills to inspire and motivate workers to initiate and listen to new ideas.

Six participants (50%) posited that start-up leaders in technology need to consider both the technical aspect of an invention and the aspect of business management. Only one of the two factors of gaining experience hinders the progress of start-ups. Many start-up leaders are experienced in business management, according to P6, but have little or no knowledge of technical aspects. This lack of balance between knowledge of technology and industry hinders the success of technology start-ups.

Five participants (42%) suggested that learning from the previous failure is an attribute to the capacity of a leader and helps leaders solve obstacles that are typical of start-up technology. P2 and P5 noted that a leader with experience and wisdom of past failures is well prepared to deal with the difficulties involved in running a complex operation such as a start-up of technology. P6, P7, and P9 suggested that leaders who have never struggled could develop an arrogant attitude and extreme self-confidence that could inevitably lead to start-up failure.

Table 4. New patterns emerging from Question 4

|

Pattern |

Participants |

No. of responses |

% of participants |

|

Diverse skills and experience |

2,3,4,5,6,7,8,9,10,12 |

9 |

75 |

|

Leadership skills |

2,3,5,6,7,9,10 |

7 |

58 |

|

Technical and business experience |

2,5,6,9,10,12 |

6 |

50 |

|

Past failures |

2,5,6,7,9 |

5 |

42 |

Question 5 asked the following: What factors have you found to influence your ability to prevent start-up failure, other than leadership? As examples, please refer to variables such as structure, culture, location, legal, marketing, networking, and firm size. Two themes emerged from the answers to Question 5 (see Table 5). Theme 8 is lack of innovation and technological competitive advantage. Theme 9 was poor marketing.

The aim of Question 5 was to differentiate between factors related to leadership and factors other than leadership that affect technology start-ups’ failure. Eight interviewees (67%) said products produced by a start-up in technology must have a technological competitive advantage. P7, P8, P9, and P12 argued that if the company could not compete with existing products in the market, products without a technological competitive advantage would be doomed to fail. Six participants (50%) replied that the products of the company must be innovative. P3, P5, P6, and P7 argued that the products of a start-up must be innovative as well as have a technological competitive advantage.

Sixty-seven of participants stated that poor marketing can lead a start-up to failure. P12 mentioned that most of the start-ups are failed to find the right marketing team and they are not market their products at the right time which results in running out of cash and a lower conversion rate.

Table 5. New patterns emerging from Question 5

|

Pattern |

Participants |

No. of responses |

% of participants |

|

Technological competitive advantage |

1,3,4,5,6,7,8,9,12 |

8 |

67 |

|

Product innovation |

3,5,6,7,9,12 |

6 |

50 |

|

Poor marketing |

3,5,6,7,9,10,12 |

7 |

58 |

Question 6 was as follows: What were the critical characteristics of the market you approached and how did the competition in the industry impact your failure? In order to answer this question, participants reflected on their ideas about the market and the competition, and theme 10 was initiated as get outcompeted. Forty-two percent of participants stated that competition heavily impacted their failure. Initially, they hadn’t realized that there would be such competition, which was because of their poor market research. P6 said that it’s mandatory to understand your competitors and their business models and make sure you have enough resources to sacrifice because of the competition (Table 6).

Table 6. New Patterns Emerging From Question 6

|

Pattern |

Participants |

No. of responses |

% of participants |

|

Get outcompeted |

1,3,4,5,6 |

5 |

42 |

Question 7 was as follows: What was your understanding about pivot? The intention of this question was to understand how they apply pivot as a survival strategy and what their expression about pivoting is. Seven participants (58%) expressed their idea about pivoting. Out of these lived experiences, theme 11 has emerged as pivot. Failure to pivot and pivoting went bad emerged as sub-themes (see Table 7).

Four participants mentioned that failure to pivot when needed led start-ups to an early failure. P4 expressed that if they found out their ideas are not working prior to running out of cash, they will survive. P10 also expressed a similar experience by saying that there was an opportunity if we pivot.

Twenty-five percent of participants indicated that their pivot went bad while expressing that a pivot can make both positive and negative impacts on the company. P3 said that they lose the focus of their niche market and wanted to expand to a larger market (the company wasn’t ready), which lead to their failure at the first point.

Table 7. New patterns emerging from Question 7

|

Pattern |

Participants |

No. of responses |

% of participants |

|

Pivot |

3,4,5,8,9,10,12 |

7 |

58 |

|

Pivot went bad |

3,5,12 |

3 |

25 |

|

Failure to pivot |

4,8,9,10 |

4 |

33 |

Question 8 was as follows: What was the impact of investors and related activities on your start-up? This question was intended to understand the correlation between investors (angel investors, venture capitalists, and stakeholders) and business-related activities. Theme 12 has emerged as venture capital financing. Nine participants (75%) suggested that start-up failures were due to venture capitalists (VCs). The primary emphasis of VCs was on short-term targets, according to P9, and they planned to rapidly accumulate high profits (see Table 8). In order to speed up processes such as time-to-market, even though speed hindered efficiency, the VCs forced start-up managers into shortcuts. P7 claimed that the decision-making phase of VCs was long, often resulting in a lack of time for strategic decisions to be implemented. P17 noted that start-ups in technology need to be agile so they can adapt quickly to changes in the market. Finally, VCs enforced strict policies and procedures that had a detrimental effect on technology start-ups’ much-needed nimbleness.

Table 8. New patterns emerging from Question 8

|

Pattern |

Participants |

No. of responses |

% of participants |

|

Venture capital financing |

1,3,4,5,6,7,9,10,11 |

9 |

75 |

Question 9 was as follows: How did the capital structure impact the start-up’s failure? Participants defined the capital structure they posed in order to address Question 9 in terms of timing, size of the investment, type of investor, equity requirements, and loans, among others. The negative effect VCs had on the success of technology start-ups was emphasized by eight participants (67%). P3, P4, P8, P10, and P11 suggested that the start-up’s capital structures hindered the organization from operating effectively and posed challenges to its progress. Since VCs owned significant proportions of start-up equity, they enforced strict processes for decision-making. In prior interview questions, participants repeated similar comments. Because of that, from question 9, no new patterns emerged.

Question 10 asked the following: What cultural factors have you found that impact the failure of technology start-ups? Eight participants (67%) suggested that cultural factors did not impact the failure of start-ups in technology (see Table 9). Participants P2, P4, and P5 replied that in their initial process, there was no need for a structured culture in a technology start-up. All start-up employees were multifunctional and self-motivated, performing any task necessary according to P2. Such workers did not need a formal system of organization, policies, structured meetings, or a code of conduct. Participants P5 and P12 concluded that, since they limited the versatility and creativity of start-up employees, these cultural factors could also impede start-up success. P5, P6, and P8 thought that one of self-initiative, quality, pace, can-do attitude, and the belief that no job is too small was the culture in most of the tech start-ups. Participants did not connect culture to the start-ups or their failures. From Question 9, no new themes were developed.

Table 9. New patterns emerging from Question 10

|

Pattern |

Participants |

No. of responses |

% of participants |

|

No influence |

2,3,4,5,6,7,8,12 |

8 |

67 |

Question 11 asked the following: What are the most important elements of a successful technology start-up based on your experience? The aim of Question 11 was to understand how participants describe a successful start-up of technology and what they consider as important features needed for a successful start-up. The inventors and founders of a technology start-up are the most important factor in the company’s success or failure, six participants (50%) said so. As an integral aspect of a successful technology start-up, five participants (42%) suggested technological competitive advantage. In the dynamic world in which technology start-ups compete, P6, P9, and P11 concluded that start-ups that have products but no technological competitive advantage would not succeed. Three participants (25%) suggested that demand and the product–market fit were crucial to the start-up’s success, whereas four participants (33%) emphasized that innovation is critical to start-ups’ success. From Question 11, no new trends arose.

Question 12 asked the following: Are there any decisions you wish you had made differently when you were running your start-up? The aim of Question 12 was to decide if, during the initial or maintenance process of the start-up, participants would have made various decisions. The majority of participants (67%) suggested that they would have collected more funds to alleviate cash flow requirements and finance research and development projects (see Table 10). Six participants (50%) suggested that inventors were responsible for the failure of start-ups, and 42% of participants wished decisions to be taken on a timely basis. From Question 12, no new theme emerged.

Table 10. New patterns emerging from Question 12

|

Pattern |

Participants |

No. of responses |

% of participants |

|

Raise more funds |

1,3,4,5,6,7,8,9,12 |

8 |

67 |

|

Inventors |

3,5,6,7,9,12 |

6 |

50 |

|

Timely response to changing conditions |

3,5,6,7,9 |

5 |

42 |

DISCUSSION

Discussion of emerged core themes

The paper presented 12 core themes under the study findings. The core themes that emerged from the qualitative phenomenological study addressed the key research question: What are the critical factors that are impacting on failures of tech start-ups in Sri Lanka? The comparison of the study themes with the outcomes of related research was challenging because there was minimal publication of literature on technology start-up failures in other countries and in Sri Lanka. Some of the themes coincide with the results of studies performed in other countries, although those previous studies have not identified the rest of the themes.

- Financial uncertainty. Both respondents described financial uncertainty as an obstacle to the success of start-ups (Questions 1, 2, 3, 5, and 9). Several causes of financial instability were identified by the participants. Nine participants noted that they lacked money, and they expected more funds to be collected than they actually did. P4 said start-up leaders should collect more funds than needed: “Don’t run out of cash.” P13 noted that funds should be collected “whenever possible, rather than when necessary.”

These results are compatible with previous research (Cressy, 2006; Simmons, 2007; Song et al., 2008). The challenge of accessing financial capital hinders a small firm’s progress, according to Simmons (2007). Financial resources have been described by Song et al. (2008) as key to the success of technology ventures.

Eight participants (67%) listed the capital structure as a source of start-up failure (Question 9). Instead of accepting the investment as a loan, P9, P10, and P11 argued that start-up management should issue equity to investors. Based on the experience of those participants, equity holders were more committed relative to financial investors to the strategic objectives of the company. P3 and P9 suggested that all shares should be distributed as common shares. Unrest and antagonism among shareholders were generated by the allocation of various class shares, such as common versus preferred.

- No market research. Most of the respondents said that market research and marketing were key factors in the success of start-ups (Questions 1, 2, 3, 11). The results coincided with previous research. Nine aspects of marketing have been defined by Song et al. (2008), such as competitive strength, environmental dynamism, breadth of market development, and product innovation. Six participants (50%) in the current study described unfamiliarity with consumer demands as an obstacle to start-up success (P1, P2, P5, P7, P10, and P12).

P1 claimed that changing industry conditions could lead to products that have no market demand. The need for the product could diminish or become non-existent by the time the product is ready to launch. P5 indicated that innovative products should solve real consumer needs rather than “the wishful thinking of an inventor”. P10 argued that an innovative product precedes a problem in certain situations, resulting in a successful product for a non-existent problem/market.

- No product–market fit. All participants except P2 and P8 (ten participants, 83%) agreed that no product–market fit is the most crucial fact that threatens start-up success. P10 stated that most of the start-up founders, often called visionaries, have their own imagination that is contributing to the innovation of products, but that same imagination can lead to failure because of less concern about the market fit. During the first 2 years of operations, the chances of failure for small companies are highest (Cressy, 2006), because whether they have an innovative product they don’t have a market to reach, there is no real customer need. According to Cantamessa et al. (2018), if the product or service can theoretically meet needs or fix problems, but these are actually not experienced by consumers, this is a more serious case of wrong product–market fit.

- Paranoid behavior of inventors. Nine respondents (75%) indicated that inventors were solely responsible for the failure of the start-up (Question 1). P3, P9, and P12 noted that inventors were suspicious and hesitant to share the information and expertise they possessed with other members of the company. Start-up success was hampered by this lack of collaboration. P10 argued that inventors “are in love with their invention” and that their invention’s shortcomings or lack of competitive advantages may not be objective. Inventors also fear losing their conventional power roles in the company by sharing their expertise with their teammates (Weidenbaum, 2004), and such behavior impedes the start-up’s effective future.

- Lack of timely response to changing conditions. Seven respondents (58%) argued that failure to respond promptly to changing environmental conditions, both internal and external, could lead to start-up failure (Questions 2 and 3). Participants P3, P5, and P9 argued that rapid response to changing conditions is crucial for tech start-up success. Each stage in the life cycle of a start-up could require different skills in leadership. As such, management should make timely decisions to replace members whose strengths and characteristics are not compatible with the needs of start-ups. The participants thought that procrastination was, at times, a significant obstacle to effectively carrying out strategic initiatives.

Those findings are comparable to previous research. Previous research has shown that during the early stage, technical expertise and management skills are important and may vary from those needed in the midlife stage (Jones, 2007; Newstrom & Davis, 2002; Rutherford et al., 2004). Organizations move through stages known as life cycles, and each stage can require different skills and styles of leadership (Swiercz & Lydon, 2002). To minimize failure rates, leaders who lack suitable skills should be replaced in a timely manner.

- Location of the venture. Six participants (50%) suggested that the start-up location greatly impacted the company’s success or failure (Question 5). The study’s results were consistent with previous studies. Location becomes crucial as it defines customer usability, according to Simmons (2007).

The Internet started to alter the position of the organization and its effect on small business failures. As shown by the participants, the Internet has become an important part of their businesses, supporting Wyse’s findings (2004). Gupta and Govindarajan (2004) recognized that there was an effect on physical location, but argued that attention should also be given to how the Internet and e-commerce reshaped the way business was completed. In agreement with Gupta and Govindarajan, many small business owners can eliminate the characteristics of physical boundaries through their use of the Internet.

- Lack of diverse skills and experience. Nine respondents (75%) suggested that technical and business expertise is crucial to the success of a start-up in technology. The diverse and often competing interests of the company’s numerous stakeholders, including entrepreneurs, shareholders, boards of directors, and staff, need to be navigated by leaders.

Such findings are equivalent to previous research. Simmons (2007) observed that the expertise of business leaders is crucial to the success of start-ups. Firm success is attributed to good leadership according to Zornada (as cited in Calloway & Awadzi, 2008), while “failure or underperformance is also readily attributed to poor leadership” (p. 1). Huyghebaert et al. (2007) observed that in the first four years of service, leadership is one of the key factors affecting small businesses. It is important for potential entrepreneurs to evaluate new venture attempts in order to identify the leadership characteristics that impact the success or failure of new ventures (Fried, 2006).

Five participants (42%) proposed past failure is an advantage because failure equips a leader with the experience and wisdom to deal with the difficulties involved in running a complex operation such as a technology start-up. Such results are fresh and unexpected. The results of this study that prior failures are beneficial for a technology start-up leader were not confirmed by an analysis of previous literature. Song et al. (2008) described “the experience of the firm’s management team in previous start-up situations” as influencing start-up performance, but the researchers did not indicate whether the experience was of a successful start-up or an unsuccessful start-up.

- Lack of innovation and competitive technological advantage. Eight participants (67%) defined product innovation and technological competitive advantage as key components of a successful start-up (Questions 1 and 11). Failure to combine innovation and technical advantage may lead to start-up failure. P6, P9, and P12 argued that they will not succeed in the dynamic world in which technology start-ups compete unless start-ups had products with a technological competitive advantage. The study results are compatible with the meta-analysis performed by Song et al. (2008). The researchers described product innovation as the “degree to which new ventures develop and introduce new products or services.” Product innovation is one of the 24 factors needed for new venture success, according to Song et al. (2008).

- Poor marketing. Seven participants (58%) concluded that poor marketing results in a start-up failure. Poor marketing has been identified as not having a proper marketing plan, not having resourceful people to conduct a good promotional campaign, and not having enough money to run a prompt campaign. Tech start-ups are constrained in their capacity to promote the brand. The Internet offers a greater stage for the promotion of small businesses, but owners are still constrained because their ability to do mass advertising is impeded by a lack of capital. A negative image or stereotype follows the mark of small businesses beyond resource and advertisement constraints. Potential consumers view small companies as less capable of performing tasks than larger ones.

- Get outcompeted. Five participants (42%) mentioned getting outcompeted as a reason for tech start-up failure. According to P3, most of the tech start-ups are doing business in very competitive markets, where competitors sometimes create threats to other existing businesses ambitiously and he had to undergo such a situation many times while running the company. Most of the time start-ups get outcompeted at their early stage of the life cycle, as Thornhill and Amit (2003) endorsed by research, failures were more frequent during the early stages of the growth of a company when its leaders were less experienced and the business was small.

- Pivot. Seven participants (58%) stated that a pivot is a critical approach when it comes to start-up success or failure, as a pivot can impact a business in both negative and positive forms. As P3 explained, when start-up leaders are reluctant to take the decision of pivot this can lead to failure and, on the other hand, a pivot can go bad. Three participants (25%) expressed there are scenarios that they faced where a pivot went bad. And another four respondents (33%) responded that failing to take the right decision at the right time to pivot can lead to failures. Hampel et al. (2020) mentioned that, since their original strategy had failed, many new businesses had to pivot and fundamentally transform what they were about. For software entrepreneurial teams to make better decisions in volatile and unpredictable environments, a better understanding of the different types of pivots and the various factors that lead to failures and cause pivots are required, according to Bajwa et al. (2017). Prior study results are aligned with current findings.

- Venture capital financing. Nine respondents (75%) described venture capitalists (VCs) as an obstacle to the success of technology start-ups (Questions 1, 2, 3, and 9). VCs were focused on short-term targets, according to P8. VC managers expect that they would obtain high profits quickly. Even when speed was adverse to efficiency, they also placed pressure on start-up managers to take shortcuts to speed up processes. P8 also reported that it took too long for VCs to make decisions, contributing to the loss of precious time. By the time they make decisions, the start-up ran out of cash, key individuals left the company, and other investors were hesitant to commit additional funds. Then it is too late to stop the failure. P7 said technology start-ups should be agile and adapt quickly to changing environmental circumstances. Instead, VCs implemented strict procedures that had a detrimental effect on technology start-ups’ much-needed versatility. Davila et al. (2003) in their research, compared venture capital financing with start-up success with a positive impact but 75% of the current study did not agree with that.

CONCLUSION

The study of the experiences of 12 technology start-up leaders in Sri Lanka may lead to a better understanding of the factors causing Sri Lanka’s tech start-up failures. The 12 key themes that emerged from the study influenced the recommendations that could contribute to mitigating technology start-ups’ potential failure and resulting in lower failure rates. The researcher has summarized the recommendations into four distinct sections for better comprehension: financing, market research, leadership, and inventors.

- Financing. In the early phase of the start-up, VCs impede start-up progress based on the results of the report. Until a later point in the life cycle of the company, start-up management should avoid collecting funds from VCs. Initial funds should be collected from angel investors, strategic partners, government funds, and technical institutions. Company management should collect funds from VCs only after reaching a point that enables the company to negotiate with VCs on equal terms and attain mutually beneficial terms and conditions of investment. Although this recommendation is in contrast to previous research, it is centered on the lived experiences of nine (75%) participants in the study. VCs were identified by the participants as a significant cause of start-up failure. VCs are short-term focused, as noted earlier, and their priorities often do not fit with the objectives of the start-up. These varying objectives often lead to collusion. Negotiating on an equal basis with VCs would help to resolve historical impediments and contribute to greater start-up success rates.

- Market research. For start-ups, market research is a vital success factor. It is important to find a market niche for a new innovative product and be able to fill this niche. Seven participants (58%) reported performing market research to evaluate market requirements, but only after the organization raised funds, recruited workers, and conducted a feasibility study to assess the applicability of scientific and technical concepts. The production of the company’s products had little to no gain from doing experiments at a later point since the money had already been raised and workers had already been recruited to produce a particular product. At this point, the pivot was practically and literally impossible, leading to start-up failure. The absence of timely market research was a cause of start-up failure, six participants (50%) suggested. These results are comparable to previous research (Song et al., 2008). As such, conducting timely market research may result in higher technology start-up success rates.

- Leadership. A technology start-up is a complex activity, according to P10, as it includes various disciplines such as technology, marketing, finance, production, and management. Leaders of such dynamic activities have a critical effect on the new venture’s success or failure. It is important to pick a leader who possesses the unique needs of the start-up. The results of the study showed that a technology start-up leader must have the following three characteristics: (a) competence and skills in technology and business, (b) political acumen, and (c) experience acquired from previous failures. Six respondents (50%) suggested that the technical and business backgrounds of leaders are essential to the success of start-ups (Question 1 and 4). P2 and P12 indicated that gaining expertise in only one of these two fields hinders the success of start-ups.