Tarja Niemelä, Ph.D, University of Jyväskylä, School of Business and Economics, P.O. Box 35, 40014 University of Jyväskylä, Finland, tel.: +358 407491569,e-mail: This email address is being protected from spambots. You need JavaScript enabled to view it..

Reija Häkkinen, M.Sc, University of Jyväskylä, School of Business and Economics, P.O. Box 35, University of Jyväskylä, Finland, tel.: +358 442560262, e-mail: This email address is being protected from spambots. You need JavaScript enabled to view it..

Abstract

Our study focuses on family farm firms as an important and yet under-researched type of family firms. We explore the entrepreneurial growth behavior in the context of family farm firms by focusing on the role of pluriactivity. By integrating the literature of family business strategies, EO, and growth intentions, this study of 1618 Finnish family farms seeks to understand the idea of pluriactivity as a strategic orientation of family farm firms leading towards the growth and renewal of their prevailing and future domains. Our study revealed that pluriactivity is associated with growthorientation and perceived strengths of the family farm firms. We identified four types of growth groups (Established, Growth-Driven, Experimenters, Stand-Stills) and found differences in their pluriactive orientation. We suggest that pluriactivity as a strategic orientation affects the growth-intention of the family entrepreneurs and the business renewal processes of the family farm firms. Entrepreneurs need to have capabilities (knowledge, skills, experience) and willingness to change (motivation, attitude, volition) when using pluriactivity as a strategic orientation as they affect growth behavior (EO). Lastly, we discuss with our results and make some suggestions for future research avenues in family business strategy research.

Keywords: pluriactivity, family farm firms, intentions, growth, renewal, strategy.

Introduction

Family firm, family farm businesses and their growth strategies have rarely been researched among family business and entrepreneurship researchers (Chrisman, Chua, and Sharma, 2005; Alsos, Carter, Ljunggren, and Welter, 2011; Webb, Ketchen, and Ireland, 2010). We do not know much about the growth strategies of family businesses (Astrachan, 2010). The overall scope of the family firm strategy research has been narrow (Goel, Mazzola, Phan, Pieper, and Zachary, 2012).

Recent studies have focused on, among other issues, strategic behavior in firm performance (Chrisman, Steier, and Chua, 2008) exploiting the unique resources of family firms (Miller and Le-Breton-Miller, 2005) and their capabilities and their financing. However, they have not focused on functional alternatives (Coleman and Carsky, 1999) and the future plans of entrepreneurial families (Miller, Le Breton-Miller, and Lester, 2013). Prior studies have also focused on strategic decision making (Holt, 2012) and planning as a strategic practice in family business context (Nordqvist and Melin 2010) but also generational perspective to strategic planning and succession planning in privately held family firms (Eddleston, Kellermanns, Floyd, Crittenden, and Crittenden, 2013). However, not many studies have focused on family farm strategies and their growth behavior (Ketchen, Webb, and Ireland, 2010).

Pluriactivity is one concept that has the potential to be considered both as a source of livelihood of farm households (Newton, 2006) as well as a source of growth (Grande et al., 2011a). In this research we are interested in the latter form. In spite of the current interest in pluriactivity as a form of growth and renewal in family farm firms (Grande et al., 2011a), there is still only a little information on how pluriactivity can be viewed as a strategy for business renewal, scanning the environment and moving towards branches that derive from family farmers’ own interests and capabilities. A multiplicity of anecdotal clues as well as theory and empirical evidence support the proposition that family farm firms use pluriactivity as a growth strategy and dynamic renewal. (see e.g., Ketchen, Webb, and Ireland, 2010). However, it remains unclear what growth indicators are linked to pluriactivity and what are the dynamics behind how and why family farm firms develop their growth strategies. We fill this research gap by investigating growth behavior of family farm firms and its effects to realized growth in family farm firms in order to deepen our knowledge of the meaning of pluriactivity for the survival and continuity of family farm firms.

We refer to pluriactivity both as an entrepreneurial process of new business creation as well as a means for business growth. Specifically, we wanted to look at the visibility of growth and strategic renewal in the entrepreneurial behavior of farm firms and revisit the two concepts from the pragmatic perspective of agriculture to gain and name a micro-level perspective for the family farm growth process. As growth, pluriactivity can increase the variety of business branches when business would otherwise be non-profitable. Thus, for the purpose of our research we use the term renewal as a strategy of making changes. We see renewal in family farms as a continuous re-evaluation of the use and recombination of resources. Growth in family firms can be both economic and non-economic (Chrisman, Chua, Pearson, and Barnett, 2012).

As we are interested in the idea of the pluriactivity that branches out beyond traditional agriculture and forestry, and pluriactive orientation of family farm firms leading towards the growth and renewal, our main research question is: What is the role of pluriactivity for family farm firms’ continuity and survival? We also examined if there were connections between the new business creation processes and growth intentions and explored whether there were differences in terms of their pluriactive strategic orientation between various types of growth groups of family farm firms. Our data consists of consolidated findings from a survey of 1,618 Finnish family farm firms.

We contribute to the literature of family business strategy by examining farm firms’ livelihood strategies, growth, and entrepreneurial orientation. As we study growth behavior in the family farm firms as pluriactivity comprising of growth and entrepreneurial intentions, we apply a diversity of theories and approaches of family business strategies to indicate the possibilities of pluriactivity research.

The remainder of this article is organized as follows. Firstly, we present an overview of the relevant literature and the development of our hypothesis. Secondly, we explain our research design and present our empirical results. Lastly, we discuss our results and draw implications for family business management and policymakers but also provide suggestions for further research.

Literature review

Family business strategies, growth behavior and pluriactivity

Family firms represent the majority of businesses in most countries and are known to be the oldest form of business that pervades the world (e.g. Ifera, 2003; Zachary, Rogoff, and Phinisee, 2011). Family firms are essential for economic growth (Astrachan and Shanker, 2003) and development through new business startups and growth of existing family firms (Kellermans, Eddleston, Barnett, and Pearson, 2008). Family firms comprise a larger portion of rural economies compared to urban economies and rural economies are smaller than urban ones. Wealth-being of rural communities and citizens is closely linked to health of their locally owned family firms (Brewton, Danes, Stafford, and Haynes, 2010). Many of those rural businesses are small businesses, and as Habbershon (2006) states, family influence is more extensive in smaller firms. Family firm distribution is different in rural and urban areas, thus agriculture and small family firms comprise a large portion of economies while they both are riskier than average.

The influence of family embeddedness on firm growth and performance is complicated (Astrachan, 2010) because family actors are embedded in multiples social systems and that the nature of the embeddedness has also economic implications. Thus it is necessary to draw attention to both the negative and the positive aspects of social embeddedness of family firms. Family businesses are unique and complex because the reciprocal impact of the family and the firm (Sharma, 2004).

family business strategies and growth behavior

The research of strategic performance of family firms deepens our understanding of the relative performance of family and nonfamily firms, as well as aspects of family firm’s strategic behavior that are expected to have a profound influence on performance. (Chrisman, Steier, and Chua, 2008). Family influence seems, in some instances, to function as a moderator of the relationships between strategy and performance (Sirmon, Arregle, Hitt, and Webb, 2008). In other instances, the impact of family influence itself appears to be moderated by strategic and structural context of the organization.

Researchers have become interested in how the unique interactions surfacing family involvement influence both entrepreneurship and strategy in family firms (Pittino and Visintin, 2011). Family firms’ strategic orientation or entrepreneurial behavior is expected to have profound influence on performance. Family farm firms use their power to decide which strategic alternatives to pursue and the intensity with which they are pursued (Arregle et al., 2012; Nordqvist, 2005).

The entrepreneurial strategic orientation has been researched in family businesses as EO (entrepreneurial orientation) although some researchers have been skeptic about its suitability in family business context. (e.g. Zahra, 2003). Entrepreneurial orientation refers to a firm’s strategic orientation, capturing specific entrepreneurial aspects of decision-making styles, methods, and practices. As such, it reflects how a firm operates rather than what it does (Lumpkin and Dess, 1996). Family businesses are characterized to be important innovators (Kellermanns et al., 2008) as they have to enter new markets with innovations to ensure the survivability over generations (Casillas, Moreno, and Barbero, 2010). Concerning the individual dimensions of entrepreneurial orientation, each can have a universal positive influence on growth (Wiklund, Patzelt, and Shepherd, 2013) as growth models describe the factors affecting attitude and strategic orientation (Covin and Slevin, 1991).

Recently, there has been some interest in how family involvement influences entrepreneurship (e.g., regarding entrepreneurial orientation and opportunities) and strategy (e.g. regarding overcoming competitive threats, providing balance in decision-making, or determining value of resources) in family firms (Webb, Ketchen, and Ireland, 2010). Zellweger, Nason, and Nordqvist (2012) regard risk taking and innovation as critical components of EO for business families. Zahra (2005) found that risk taking seems to diminish over time in family firms.

Entrepreneurial behavior in family businesses is discussed ambiguously. Family firms are often referred to as being conservative, risk-averse and cautious against innovation (Chrisman, Steier, and Chua, 2006; Nordqvist, and Melin 2010) because family business owners are paying more attention to sustainability to ensure a reliable income for family members of the next generations.

Entrepreneurial behavior may affect family firms both positively and negatively. Thus, the involvement of family does not necessarily result as outperformance or neither enhances resources of competencies of the family businesses. For example, Casillas, Moreno, and Barbero (2010) noticed a positive effect of family involvement on the relationships of innovativeness and growth, but showed no significant effect on the relationships between other characteristics of entrepreneurial orientation and growth of a family business. Casillas et al., (2010) found that EO positively influences growth only in second-generation family businesses, and that the moderating influence of the generational involvement is related to the risk-taking dimension. Also both dynamism and hostility of the environment moderate the relationships between EO and growth in a positive sense.

Several individual factors seem to affect growth such as professional experience and technological competence and team spirit (Friar and Myer, 2003), networks, (Robson and Bennet, 2000). Several authors have found a positive correlation between growth intentions and actual growth (Kolvereid and Bullvåg, 1996; Bellu anand Sherman, 1995. Le Brasseur, Zanibbi, and Zinger (2003) examined activities preceding business start up, growth intentions, actual development, business success, and the connections between these. Their results show that diverse participation in the tasks required to start an enterprise indicates the existence of growth intentions and is connected to desired and actual growth.

Along with any tangible and determinable benefits, intentions that guide business operations determine an entrepreneur’s growth drive. Intentions directly impact personal behavior that result from personal attitudes towards specific behaviors and from the social pressure to engage in certain types of behaviors (Fishbein and Ajzen, 1975; Ajzen and Fishbein, 1980). Intentions can equally well explain a firm’s profitability and growth (Bird 1988, 1992). Orser, Hogarth-Scott and Wright (1998) have found a statistically significant connection between entrepreneurial motivation for growth and actual growth. Intentions are a useful research perspective when, for example, the enterprises are divided into growth-driven ones and non-growth-driven ones.

The examination of family-specific factors on entrepreneurial behavior in family firms is scarce (Chrisman, Steier, and Chua, 2008; Kellermanns and Eddleston, 2006), and researching the phenomenon is also challenging because family businesses are a rather heterogeneous business type (Sharma, 2004). Because the concept of growth within the framework of this study is based on the quantitative changes in a firm’s business operations over a specific period of time, it may be difficult to distinguish growth and development in practice. The two may interact in a positive cycle where development enables growth and growth enables development. Firms need to change in order to grow, and changing companies grow by default. With the relationship between growth and development in mind, our first hypotheses derive from intentions:

H1. Pluriactive family farm entrepreneurs are growth driven.

Pluriactivity in family farm firms

Discussion of pluriactivity has ranged from a household perspective towards entrepreneurship to strategy-related issues. Resource-based and opportunity recognition theories (Jervell, 2011) in particular have been identified as capital accumulation strategies and as survival strategies in environments that are challenging regarding resources (De Silva and Kodithuwakku, 2011) Pluriactivity could thus be viewed as a strategic outcome and exploitation of this newborn knowledge. De Silva and Kodithuwakku (2011) suggest that accumulating wealth by pluriactivity could characterize entrepreneurial households. They argue that necessity-driven and socioeconomically worseoff farms were more survival oriented than better-off and more successful farms, which were more opportunity driven as a means of preserving their viability as well as that of entire rural areas (Jervell, 2011; Grande, 2011b; Kinsella, Wilson, de Jong, and Renting, 2000). Carter has noted (1998) that pluriactive farmers would not prefer to be wage-earners but are differentiated by their relative youth, greater experience and training. They choose to specialize rather than continue traditional mixed farming. Pluriactive farmers are said to take more risks in pursuing business success, to seek larger profits through expansion and to continually seek new markets and opportunities (Kinsella, et al., 2000; Grande, 2011b).

Our interest in pluriactivity as a form of strategy in family farm firms has led us to pay attention to strategic change processes and renewal in family firms (e.g., Agarwal and Helfat, 2009). As Hurst has stated (2002, p.1), ‘Renewal is about restoration of something of value, something important, that has been either lost or forgotten as an organization has grown and prospered. Renewal, then, is about values and the central role that they play in the lives of organizations undergoing renewal’. According to studies of Mannion et al., (2001) family farm firms chosen strategies depend upon access to capital assets such as human, financial, natural, social and physical. These assets relate to skills, knowledge, land, labor, landscape or social networks available, and vary in importance depending upon economic or political changes. Accordingly, a farm household may establish an enterprise, utilizing special skills or education (human capital assets).

Pluriactivity can be divided into an industrial pluriactive form (selfemployed in two or more enterprises), and a wage-earning pluriactive form, (involved in both self-employment and wage earning), especially when a spouse works outside farm labor markets (Eikeland, 1999; Jervell, 1999). In addition to on-farm agricultural production, this could include either onfarm non-agricultural, and/or off-farm agricultural or non-agricultural work. Though not only the industry in which households seek additional income, the extent of farm pluriactivity has increased in proportion to the decline in agricultural income, and has been undertaken by over 60 % of family farms in the EU (SOFER, 2001; see Newton 2006, 499). Accordingly, we view spouses’ work in outside farm labor markets, or further education of the farmer, as a form of exploration. To further argue this point of spouses’ work as exploration; we draw attention to the growth intentions and thought patterns behind a focus on growth. Grande, Madsen, and Borch (2011) found support for the link between the resource-based view and EO in farm firms. This link could explain how entrepreneurial efforts and unique competence positively results in superior performance at farms. However, they point out that regarding the regulated and otherwise contextual nature of agricultural industry, there might be a call for more specific measurements regarding the entrepreneurial behavior of farm firms. Grande (2011a) highlights the importance of entrepreneurial skills in developing a new farm-based venture. The farmers could highly benefit from the capacity to generate ideas, exploring the uniqueness of their own resource base (including resources at the farm, personal experience and knowledge, and surrounding opportunities). Based on the prior literature we assume that pluriactivity viewed as entrepreneurial orientation may lead to growth and renewal in family firms, which leads to our second and third hypothesis.

H2. Pluriactively growth-oriented family farm entrepreneurs base their strategies on individual skills and capabilities.

H3. Entrepreneurial orientation affects the growth of family farm firms and their renewal via pluriactivity.

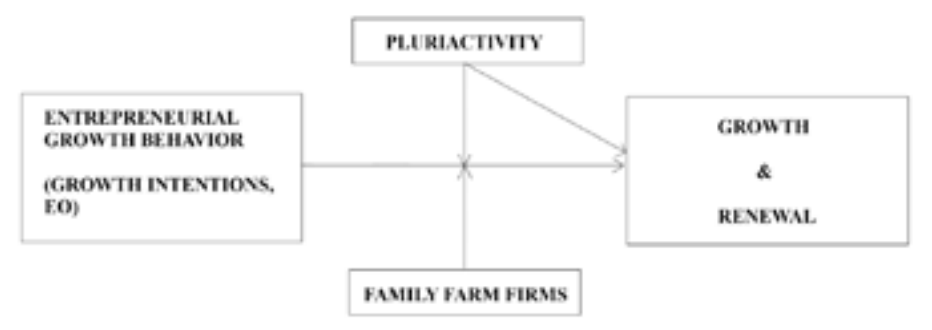

In Figure 1. we describe our main concepts and approaches as a theoretical frame of the study.

Research methods

Sample selection and data collection

To investigate our hypotheses we re-examined our consolidated findings from a survey with 1,618 family firm farms in Central Finland (Niemelä, Heikkilä, and Meriläinen, 2005).We acquired the names and addresses of 3620 family farm firms from the Information Centre of the Ministry of Agriculture and Forestry IACS (Integrated Administration and Control System) support register of 2004, and collected the data through a questionnaire sent by post to family farm firms entrepreneurs on 14 January 2005. We sent one reminder letter to the farms that did not respond to the first request. To examine the pluriactivity that branches out beyond traditional agriculture and forestry as a strategic orientation in family-owned farm firms, we developed a questionnaire utilizing the scales originally established by Niemelä et al. (2005) and using the theoretical constructs based on the literature review.

The original survey questionnaire consisted of questions directed for all family farm entrepreneurs concerning their personal, family and farm data, transfer to descendants, and the economic foundation of their farm, but also questions for farms that have created new business activities other than traditional farming (secondary and ancillary business activities, incorporated business activities) such as the nature of those business activities, various growth assessments, networking, training requirements, public sector operations and the nature of rural areas as business environments. (A.1) We tested the questionnaire on five farm firms entrepreneurs’ in December 2004. However, some entrepreneurs experienced particular difficulties in defining (characterizing) their business activities other than traditional farming (secondary and ancillary activities) and their link to farming, and in determining their core production branch. Such problems may have affected the results. The questionnaire was sent to 3620 farms of which 1618 entrepreneurs answered the questionnaire. The sample was regionally representative with response rate 45 per cent. Out of the total 1,618 family farm firm entrepreneurs 679 indicated to have new business activities and ancillary activities, namely businesses that were totally differentiated from core production and incorporated as business as its own, businesses that were deviant from core production, businesses that were developed from the core production but fixedly belonging to basic agriculture and other business activities (defined by the entrepreneurs). Some farm firms are excluded from the analyses for incomplete or partially completed survey questionnaires (n = 73). The final sample used in this study comprises 606 observations on family farm firms. Due to internal non-response the effective sample size is somewhat lower in some of the analyses. (The useable response rate was 37.5% of the final sample.)

The final sample of 606 family farm firms comprised nearly 90% of family-owned, second to fifth generation family firms, 27% of which were characterized as over 200 years old, with an average age of 50 of entrepreneurs. 80% of entrepreneurs were male. Every third male and fourth female had completed Finnish basic school (Grades 1–10). Females had more vocational education than men and 14% of the females completed a higher education degree. 60% of the males were responsible for the new business activities and ancillary business activities (other than traditional farming), and 27% of the entrepreneurial couples were responsible for them together. Thus, the working experience of the family members and size of farm businesses corresponds to the definition of family businesses used in previous family business studies. Accordingly, this kind of definition of family business fits both our study and the Nordic family farm firm setting.

As a context of the study, Finnish family-owned farms are relatively small when they are compared with other European countries. Finland’s northern geographic position restricts growing season and crop varieties, it increases costs, and it has influenced the country’s history of combining agricultural work with additional-income-generating activities. Such families may increasingly work off-farm, with agriculture as a secondary activity, particularly if growing crops (MTT Economic Research, 2005). We are aware of the other definitions used in family business contexts in an outside European countries and this may limit the comparability of our results to these other studies of family business.

The unit of analysis is the family farm firm owner when it comes to growth aspirations because entrepreneurs as individuals use their power over strategic decisions, although several other factors affect their decision making beyond family and business.

Constructs and measures

The data were largely collected on a scale, restricting the choice of analysis method. We used variable specific analysis in order to understand more holistically the phenomenon under scrutiny. We also used logistic regression analysis and cluster analysis, as both methods allow the use of nominal scale variables. The variables are listed in A.1. We also employed several proxies as a linkage between the constructs and measures to test our hypotheses when analyzing pluriactivity as a strategic orientation and growth as a qualitative process of family farm firms. We defined our constructs and measures based on knowledge gathered from previous studies (e.g. De Silva and Kodithuwakku, 2011; Kinsella, et al.; 2000; Grande, 2011; Jervell, 2011; Davidsson and Wiklund, 2013; Wiklund and Shepherd,2013; Wiklund and Patzelt, and Shepherd, 2013; Miller et al., 2005).

Dependent variables

Accordingly, as our variables were largely collected on scale, we employed the business creation process of family farm firms as a dependent variable. Based on the prior literature, we used the following proxy statement approach: the entrepreneurial orientation of family-owned farm firms affects an entrepreneur’s growth intentions. Thus, entrepreneurs’ attitude (behavior), resources (capabilities, skills, experience), and environment (family, completion, market) affect entrepreneurial orientation, and entrepreneurial orientation affects the growth and renewal of the family firms. Consequently, in family farm firms, we view growth as a qualitative process (Chandler, McKelvie, and Davidsson, 2009) and pluriactivity as a form of strategic orientation (Locket, Wiklund, Davidsson, and Girma, 2013).

Independent variables

We employed a number of independent variables. Firstly, we employed two independent variables, namely starting points for launching new business activities and perceived operational strengths of business that were analyzed as self-report measures. Entrepreneurs were asked to state two reasons for adding new business activities to traditional farming.. We found support from the previous studies regarding risk taking behavior, proactiveness (Covin and Slevin, 1991; Miller, 1983; Zahra and Covin, 1995; Zahra, 1993) and innovativeness dimensions of EO towards growth and renewal (Wiklund, Patzelt, and Shepherd, 2009; Lumpkin and Dess, 1996 ) as well as towards resource-based strategic thinking (Penrose, [1959] 1995) as entrepreneurs’ human capital, knowledge and capabilities that assists entrepreneurs in identifying opportunities and growth attitude that people start and operate their own firms for a variety of reasons other than maximizing economic returns (Davidsson, 1989; Delmar, 1997).

We also offered 10 statements to entrepreneurs to measure entrepreneurs’ intentions to launch new business activities. The concept of competitive advantage refers to the factors underlying profitability and growth (Grande, Madsen, and Borch, 2011; Collis and Montgomery, 1997) Enterprises differ in terms of measurable (e.g., facilities, production equipment, and raw materials) and difficult to measure, such as resources (company reputation, organizational culture, expertise and experience) and organizational abilities (resources, people, and process system complex). (Shepherd, and Wiklund, 2009; Wiklund and Shepherd, 2003; Wiklund et al., 2003); and take into account family members influence on strategic planning (Casillas and Moreno, 2010; Pittino and Visintin, 2011). Especially, Nordqvist (2005) identifies strategic proximity and strategic persistence as potential source of family firms’ competitive advantage.

We also discovered subgroups among the respondents from the primary and secondary reasons for launching business activities and two other interesting groups with divergent starting points for launching business activities. Thus, we used variable specific analysis to compare each group to our observations of the three groups, individually to the total sample of family farm firms. Second, we requested the entrepreneurs to state two factors they perceived as their operational business strengths. We provided 10 statements to measure what entrepreneurs considered being their operational strengths.

Measuring these items was inspired by work of Mannion (2001), whose research was focused on family farm firms chosen strategies depending upon access to capital such as human, financial, labor, landscape, knowledge and skills, social networks, and how a farm household may established an enterprise utilizing skills and education. To adapt these measures to wide variety of family businesses possess a specific set of resources and capabilities (Sirmon, and Hitt, 2003) that may promote or constrain entrepreneurial activities (Zellweger, Muhlbach, Sieger, in press) and studies on pluriactive farming households and their farmers point the age and education effects on constraining agricultural and non-agricultural opportunities (Hill, 2000; Jervell, 2011; De Silva, and Kodithuwakku, (2011). We also wanted to profile these groups by performing a variable-specific analysis in order to compare each of the groups to our observations of the previously indicated other three groups.

Secondly, we used two other kinds of independent variables to assess growth intentions of family farm firms. We used variables that measure the current significance of pluriactive business activities, and variables that measure the intensity of development intentions concerning pluriactive business activities. By these two variables we want to measure the significance of pluriactive business activities for family farm firms. The first variable illustrates the entrepreneurs’ reports of the “current financial significance of pluriactive business activities”. We provided five statements, such as “extra income and natural supplement for basic agriculture”, “extra income but not related to basic agriculture”, “an important source of income”, “mainly a nice hobby”, “other” that measure the financial significance of non-traditional business activities (A, Q39) .

The other variable provides an estimate of turnover distribution between basic agricultural activities, supplementary and ancillary business activities, and incorporated business activities (A, Q42). We combined the turnover of supplementary and ancillary activities and incorporated entrepreneurial activities and divided the variable “The Proportion of Turnover” into five categories, even though information was lost in the process. We also measured the variable of development intentions on the basis of the entrepreneurs’ estimates of the development of any income gained through non-traditional business activities over the next three years (A, Q36) “income will increase considerably”, “income will increase somewhat”, “income will not change significantly”, “income will decrease somewhat”, “income will decrease considerably”, “pluriactive business activities will discontinue”. Farm households were found to have been influenced by their capital assets (Mannion et al. (2001) and Kinsella et al. (2000) don’t account for pluriactivity being undertaken for non-financial reasons, but several households supported this in stating that income was not always the priority.

We also used four statements concerning entrepreneurs’ growth intention as a variable. We asked the respondents to assess the degree to which they agree with the statements by requesting the entrepreneurs to rate their opinion on a five point scale (completely disagree, moderately disagree, neutral, moderately agree, completely agree). As previous research suggests that growth in employment and sales are important, growth indicators of emerging venture performance (Delmar 1997; Delmar and Wiklund 2013; Wiklund and Shepherd 2013). Le Brasseur, Zanibbi and Zinger (2003) have examined activities preceding business start-up, growth intentions, actual development, business success, and the connections between these. Their results show that diverse participation in the tasks required to start an enterprise indicates the existence of growth intentions and is connected to desired and actual growth. Also Kolvereid and Bullvåg (1996) along with Bellu and Sherman (1995) found a positive correlation between growth intentions and actual growth. Delmar, Davidsson, and Gartner (2003) have divided growth-driven companies into seven categories on the basis of a cluster analysis. Enterprise attributes – age, size, and branch of industry – distinguish the seven types. Also growth models describe the factors affecting entrepreneurial attitude and strategic orientation. Covin and Slevin (1991) created a model to describe the factors affecting entrepreneurial attitude and the influence of attitudes. They confer three attributes to entrepreneurial orientation: a tolerance of uncertainty (risk taking), innovation, and proactiveness, standing out among competition.

Control variables

We utilized number of control variables in our study. First, we controlled issues that could influence family farm firm growth on individual and family level. We controlled age and gender of farm entrepreneurs since age and gender is seen as an antecedent of entrepreneurial behavior and growth of family firms, but also because the age of the farm household members influences the extent and type of pluriactivity (Carter 1998; Hill, 2000). We controlled for family influence related issues (Is your farm a family firm?) in order to identify family and non-family respondents because our study was on family farm firms (how many family members were working at the family farm firm, and family members who are responsible for the other business activities and ancillary businesses, and form of ownership), as these may have influence on the strategic behavior of family farm firms (Astrachan, 2010; Sirmon et al., 2008).

We also controlled the education level of entrepreneurs and his/her spouse because livelihood opportunities were constrained by education (or lack of it) a good education should therefore enhance both the employment prospects (Hill, 2000) and effects of education on growth is positive (Wiklund and Shepherd, 2003). Furthermore, we controlled experience (entrepreneurs entrepreneurial, and industry experience such as years as an entrepreneur at the farm), and we controlled characteristics of entrepreneurial couples and family relationships (such as family’s multiple and complementary expertise) because prior research has stressed that industry can affect the planning growth relationships (see e.g. Eddleston et al., 2013). We controlled for 12 sub-industries as a business activities related to pluriactivity such as tourism, construction, wood processing to mention but a few. We asked these because, as Brannon, Wiklund and Haynie, (2013) suggest, these factors influence outcomes related to venture creation and start-up. Experience in the industry indicates the potential of managerial skills required for expanding a business, and it is found to have a positive relationship with firm growth (Covin, and Slevin, 1997)

We also control location of the farm firm as these may be an indication of the overall opportunities considering the market and demand of the farm products and services (Eddleston, et al., 2013). Lastly, we controlled the continuity of the production from the viewpoint of succession, namely production and business continuity in farms from the viewpoint of succession. However Kinsella et al., (2000) have suggested that farm households’ choices are pluriactive either to ensure a viable income or as a stage in the transition to leaving farming. We also controlled size and age of the farm firms (how long farm ownership has been held in family, area of cultivated fields) as they have identified to related to opportunity exploration and exploitation (Eddleston, Kellermanns, Floyd, Critten, and Crittenden, 2013; Wiklund, and Shepherd, 2013; Casillas, Moreno, and Barbero, 2010; Boyd, and Hollensen, 2012; Ducassy and Prevot, 2010; Nordqvist, and Melin, 2010).

Analysis / Study

Growth intentions of the pluriactive family farm firms

We used two kinds of variables to assess growth intentions: variables measuring the current significance of pluriactive business activities, and variables measuring the intensity of development intentions concerning pluriactive business activities. We used two variables to measure the significance of pluriactive business activities. The first variable illustrates the entrepreneurs’ reports of the current financial significance of pluriactive business activities:

| Extra income and natural supplement for basic agriculture | n = 264 | 45.4% |

| Extra income but not related to basic agriculture | n = 113 | 19.4% |

| An important source of income | n = 112 | 19.3% |

| Mainly a nice hobby | n = 80 | 13.8% |

| Other | n = 12 | 2.1% |

| Overall | n = 581 | 100% |

The other variable shows an estimate of turnover distribution between basic agricultural activities, supplementary and ancillary activities, and incorporated entrepreneurial activities in 2004. We combined the turnover of supplementary and ancillary activities and incorporated entrepreneurial activities. We divided the variable (the proportion of turnover) into five categories, even though some information was lost in the process:

| Less than 5% | n = 29 | 5.7% |

| 5%–10% | n = 82 | 15.9% |

| 11%–30% | n = 138 | 26.7% |

| 31%–65% | n = 145 | 28.0% |

| 66%–94% | n = 101 | 19.4% |

| 95%–100% | n = 24 | 4.6% |

| Overall | n = 519 | 100% |

We measured development intentions on the basis of the respondents’ estimates of the development of any income gained through pluriactive entrepreneurial activities over the next three years. Below are the respondents’ estimates:

| Income will increase considerably | n = 41 | 7.0% |

| Income will increase somewhat | n = 233 | 39.8% |

| Income will not change significantly | n = 236 | 40.3% |

| Income will decrease somewhat | n = 51 | 8.7% |

| Income will decrease considerably | n = 12 | 2.0% |

| Pluriactive business activities will discontinue | n = 13 | 2.2% |

| Overall | n = 586 | 100% |

We also used four statements concerning growth as a variable. The respondents assessed the degree to which they agreed with the statements. They rated their opinion on a five-point scale (completely disagree, moderately disagree, neutral, moderately agree, completely agree). The four statements are as follows (the number of respondents who commented is given in parentheses):

| We consider growth one of our key operational goals | (n = 517) |

| Growth and profitability are inseparable | (n = 519) |

| My and my family’s livelihood is more important than firm growth | (n = 517) |

| Firm growth is not an intrinsic value for us | (n = 513) |

We divided our observations into four groups in accordance with the above variables. The results of the cluster analysis are presented in Table 1. We used the groups’ average values to interpret the content of their answers and to name the groups. The groups are called: established, growth driven, experimenters and stand-stills. They differ in their growth intentions and their special characteristics in pluriactive farms.

In the group of established farm firms, activities other than agricultural and forestry business are highly economically significant. In many cases, such activities are a primary source of income. The respondents expect to see an increase in the income gained through other business activities in the next few years. Nevertheless, their expectations are moderate as their business activities are often quite stable. They acknowledge the significance of growth. They also adopt a realistic approach, valuing stable income for themselves and their families – as do the other groups – and not attributing intrinsic value to growth.

For those in the growth-driven category, income gained through pluriactive business activities is significant to family livelihood in this group. However, such income clearly constitutes a supplementary source of income. The respondents in this group are vigorously growth driven and see a strong link between growth and profitability. They also believe that their operations will expand in the next few years. This group highlights the significance of growth for business operations, as they do not really attach intrinsic value to growth. Nevertheless, this group attaches the most positive value to growth.

For experimenters, income gained through pluriactive business activities is important, but clearly constitutes a supplementary source of income. The respondents have a skeptical outlook on the future and lack vigorous growth motivation. For stand-stills, income gained through pluriactive business activities is an extremely significant source of livelihood. The respondents are apprehensive about the future. Their enterprises’ pluriactive business activities do not really have growth prospects. The respondents additionally lack the desire to grow. Compared with the other groups, they attribute the most negative values to growth. These respondents also most clearly put their family’s livelihood before business growth. They do not feel growth is currently necessary, but they do not entirely rule it out, either.

| Variables | Groups differing from each other by their growth intentions and their special characteristics in pluriactive farms | |||

|---|---|---|---|---|

| Established (other than nontraditional businesses | Growth driven | Experimenters | Stand-stills (no growth orientation) | |

| THE PROPORTION OF SALES | 4.94 | 3.30 | 2.62 | 4.00 |

| The meaning of other business activities at the moment (Q39) | 4 (The most important) | 2 (Additional income) | 2 (Additional income) | 2 (Additional income) |

| The development of other sources of business income during the next three years (Q36) | 2 (Grows) | 2 (Grows) | 3 (Unchanged) | 3 (Unchanged) |

| We consider growth to be one of our key operational goals the pivotal target in our business (Q4712) | 3 (Neutral) | 4 (Describes well) | 2 (Describes poorly) | 3 (Neutral) |

| Growth and profitability are inseparable (Q4713) | 3 (Neutral) | 4 (Describes well) | 2 (Describes poorl | 3 (Neutral) |

| My and my family’s livelihood is more important than firm growth”( Q4714) | 4 (Describes well) | 4 (Describes well) | 4 (Describes well) | 4 (Describes well) |

| Firm growth is not an intrinsic value for us (Q4715) | 4 (Describes well) | 3 (Neutral) | 4 (Describes well)/td> | 5 (Describes extremely well) |

| Observations (n = 421) | 102 | 158 | 107 | 54 |

| Total 100% | 24% | 38% | 25% | 13% |

The results above show that the farms can be divided into groups based on growth intentions. How do farms that intend to convert pluriactive business activities into a primary source of income over the next few years diverge from other farms? We asked the respondents if they meant to convert their pluriactive business activities into their most important source of income over the next three years (Q40).

The group that said ‘yes’ comprised 165 respondents (n = 591). To analyze this, we used an estimated logistic regression model (Nagelkerke R2 = .131), parameter values, and parameter significance. The significance (p) was below 0.1 (in bold face):

| VAKIO | 1.262 | .106 |

| TUOSUUNTA | .012 | |

| TUOSUUNTA (1) | -0.714 | .042 |

| TUOSUUNTA (2) | -1.817 | .001 |

| TUOSUUNTA (3) | -0.780 | .101 |

| TUOSUUNTA (4) | -1.080 | .043 |

| JATKO | .005 | |

| JATKO (1) | 0.079 | .923 |

| JATKO (2) | -1.001 | .086 |

| JATKO (3) | 0.383 | .581 |

| Q1601 (1) | -1.244 | .012 |

Slightly over a quarter of the farms aim to convert a pluriactive business activity into a primary source of income over the next three years. This was most common (42%) on farms in the others category, and least common on dairy farms (16%) and cattle farms (17%), where work and capital input tend to be strongly linked to current production. Plans concerning the production branch also depend on whether farms aim to convert pluriactive business activities into a primary source of income. This is most common on farms planning a change of production branch (42%) and least common on farms planning to maintain their current production branch (20%). Remote work on the farms also seems to indicate the desire to convert a pluriactive business activity into a primary source of income.

The results clearly indicate that a strong inclination towards pluriactive business operations is somehow connected with the level of commitment required by current farm operations. Farms involved in the other production category are not as bound by their current production operations as dairy farms. They also often have experience in business activities other than basic agriculture. Then again, they are also clearly oriented to systematic pursuit and change. These are the factors most obviously distinguishing the farms planning to convert a pluriactive business activity into a primary source of income in the near future.

Connections between business creation processes and growth intentions

Next we present our results about the connection between new business creation processes and growth intentions, and about differences in strategic orientation between various growth groups of family farm firms. (See Table 2.) Note the percentages of types of growth intentions are in boldface.) First, the results showed a statistically significant dependency (x2 = 21.8; df = 12; p = 0.040) between growth intentions and motives for start-up. The dependency between growth intentions and perceived operational strengths verges on statistical significance (x2 = 14.0; df = 9; p = 0.125). The initial motives and strengths sparking pluriactive business activities on farms are therefore generally connected to the farms’ growth orientation and to their approach to business growth. In the following sections we explain the results as short narratives describing the differences between the four groups discovered in the study.

| Motives for, and perceived operational strength of business start-ups | Growth intentions | ||||

|---|---|---|---|---|---|

| Established (living consists of other business activities) amount and (%) | Growth driven amount and (%) | Experimenters amount and (%) | Stand-stills (meaning great; no growth orientation) amount and (%) | Total, amount and (%) | |

| The foundations of business start-ups: | |||||

| Perceived compulsion | 19 (24) | 24 (19) | 12 (13) | 13 (28) | 68 (20) |

| Active | 7 (9) | 12 (10) | 13 (14) | 5 (11) | 37 (11) |

| Depended on resources | 7 (9 | 33 (26) | 31 (34) | 11 (23) | 82 (24) |

| Depended on resources and perceived compulsion | 23 (30) | 31 (25) | 22 (24) | 10 (21) | 86 (25) |

| Depended on resources and active | 22 (28) | 25 (20) | 14 (15) | 8 (17) | 69 (20) |

| Total | 78 (100) | 125 (100) | 92 (100) | 47 (100) | 342 (100) |

| Perceived strengths of the activity | |||||

| Depended only on resources | 34 (39) | 70 (52) | 49 (53) | 21 (46) | 174 (48) |

| Resources and cooperation | 17 (19) | 15 (11) | 16 (17) | 4 (9) | 52 (14) |

| Resources and quality | 21 (24) | 26 (19) | 10 (11) | 7 (15) | 64 (18) |

| Resources and marketing know-how | 17 (19) | 25 (18) | 18 (19) | 14 (30) | 74 (20) |

| Total | 89 (100) | 136 (100) | 93 (100) | 46 (100) | 353 (100) |

Established

The established group experienced a higher than average level of necessity to launch new pluriactive business activities. Their strengths were largely based on quality and cooperation. They were the least resource-oriented in terms of business creation and strengths. The farms reached a situation where, in many cases, pluriactive business activities already constituted a primary source of income and the respondents had a positive approach to and positive expectations concerning growth. This group covers approximately a quarter of the pluriactive family farm firms. The entrepreneurs in the established group can be described as follows: They are mainly younger than in the other groups and they have the least entrepreneur experience. Many have started pluriactive business activities at an early stage in their career as an entrepreneur and are now more or less established. The significance of forestry income and income transfers is the lowest in this group, while the significance of income from other business activities is the highest. The respondents also have high salary income. These family farmers have the least cultivated area and are the most unsatisfied with the current state of agriculture and future profitability. The production branches of family farm firms fall under the other business activities category more often than in the other groups. Another indication of the established nature of the group’s entrepreneurial base is that they plan to hire external labor in the near future more often than the growth-driven farms where economic growth is often still in the planning phase.

Growth-driven

Growth-driven family farm firms are highly average, particularly regarding their starting points for business activities. This group experienced necessity slightly less frequently than the other groups and relied on resources slightly more than the other farms engaged in pluriactive business activities. Their resource-oriented starting points manifest rather strongly in their perception of their perceived strengths, as does quality. These farms seek cooperation rarely. The connection between start-up and growth drive is therefore tinted with resource orientation, quality orientation, and a lack of necessity. The entrepreneurs state economic reasons as their motivation for growth, including obtaining a sufficiently profitable operational scale or crossing the market entry threshold. (see Table 1). The marginal benefit for expanding business operations is high in this group.

Growth-driven enterprises cover over a third of all the farms engaged in pluriactive business activities. They cultivate a slightly larger than average area. This group includes the farms that have been in a single family for the longest, the farms which attach the highest significance to agricultural and forestry income, and the farms which are the most satisfied with the current state of agriculture and future profitability. The group includes a slightly higher than average percentage of grain-growing and dairy farms. Established and growth-oriented farms planned a change in the form of enterprise ownership or company type clearly more often than the other groups. This indicates a more active level of business planning.

Overall, the group did not significantly diverge from all other farms engaged in pluriactive business activities. This lack of divergence indicates that, in practice, a high percentage of farm firms engaged in such activities can be growth-driven, because this requires no particular or exceptional starting point or strengths. The results could also mean that an entrepreneur family’s specific conception of their own orientation (intention) dictates their growth drive to a greater extent than any necessity, resources, or active objectives underlying business start-up, or any perceived business strengths.

Experimenters

Experimenters experienced the least necessity to launch other business activities. Then again, their operations are clearly the most resources-based. This group is also the most active and aspiring one (unlinked to resources). They have the narrowest strength-base of all the groups and their strengths often rely on resources alone. These respondents additionally define cooperation as a strength more often than average and they rarely consider quality to be a strength. This group covers approximately a quarter of the farms engaged in pluriactive business activities. They have the largest share of income from agriculture and forestry and the smallest share of salary income and income from other business activities. The farms in this group have the most cultivated area. The group includes a higher than average percentage of dairy farms. The respondents in this group additionally have children more often than average.

The respondents are therefore experimenters who are engaged in a smallscale business built on a narrow resource base (e.g., production facilities, equipment, or limited expertise). Time will tell whether they will grow or discontinue their operations. Engaging in pluriactive business operations is not always a suitable method of improving livelihood.

Stand-stills

Stand-still farms have experienced the most initial necessity (unconnected to resources) to engage in pluriactive business activities. They also present the lowest levels of activity and pursuit. They diverge from the other groups in many ways in terms of strengths. They consider market competence to be a strength more often than average, but perceive cooperation and particularly quality as strengths less frequently than average. Quality is not a relevant factor, possibly because the respondents started because they felt they had to, and then managed to enter the market on their own.

This group is the smallest of the four, covering approximately one out of eight farms engaged in pluriactive business activities. Their livelihood is the most dependent on salary income and income transfers. They have less than average cultivated area, they are on average slightly older than the other respondents and they have been entrepreneurs for longer than average. Their primary production branch falls under the other production category more often than average. The percentage of entrepreneurs planning to reduce the number of permanent employees is significantly higher in this group compared with the others, meaning that the entrepreneurs are preparing to cut back their operations or discontinue them.

The specific needs of this group are difficult to determine. Pluriactive business activities are significant to them, but they do not really have growth prospects. There may be a call for some form of reorganization to pull them out of their stand-still state, such as diversifying competitive advantage and identifying growth opportunities or a realistic method of discontinuing operations.

Summary

The element of necessity does not appear to be connected with growth intentions or the initial level of activity in pursuing business start-up. However, both dimensions remain underlying factors. On the contrary, growth drive does not seem to be a relevant factor in situations where the exploitation of resources is combined with strong motivation. Pluriactive orientation was a strong underlying factor in the growth-driven group, more so than in the other groups. Growth-driven business activities, along with other farm business activities, appear to be the combined outcome of opportunity and will, and that it is possible to distinguish different life cycle stages in the process of renewal and discontinues of family farm firms.

Discussion and conclusions

Our study focuses on family farm firms as an important and yet underresearched type of family firms. We have investigated the pluriactivity that branches out beyond traditional agriculture and forestry and which acts as a strategic orientation of family-owned farm firms. Our main research question was: What is the role of pluriactivity for family farm firms’ continuity and survival? More specifically, we have examined whether there is a connection between new business creation processes and growth intentions, and explored whether there are differences in strategic orientation between various growth groups of family farm firms. To carry this examination out, we used the consolidated findings we received from a survey of 1,618 family farm firms in Central Finland. We employed proxies such as growth intentions, entrepreneurial orientation, and family firm essence approach to test our hypotheses. We wanted to look at the visibility of growth as strategic renewal, revisiting the concepts from the pragmatic perspective of agriculture.

Our study revealed that pluriactivity is be associated with growthorientation and perceived strengths of the family farm firms. We identified four types of growth groups (Established, Growth-Driven, Experimenters, StandStills) and found differences in their pluriactive orientation. We suggest that pluriactivity as an entrepreneurial orientation affects the growth-intention of the family entrepreneurs and the business renewal processes of the family farm firms. Entrepreneurs need to have capabilities (knowledge, skills, experience) and willingness to change (motivation, attitude, volition) when using pluriactivity as a strategic orientation as they affect growth behavior (EO). Next, we discuss with our results and make some suggestion for future research avenues in family business strategy research.

Prior research has suggested that growth in family firms can be based on economic and non-economic goals. Family-oriented goals could be understood as dimensions of family firm behavior and performance, which in turn may be seen as a multidimensional concept (Chrisman et al., 2013; Basco, 2013; Astrachan and Jaskiewicz, 2008).

Our findings show that various factors contribute to business creation, and we used these factors to categorize entrepreneurs into four growth groups: established, growth-oriented, experimenters, and standstills. Our first hypothesis - pluriactive family farm entrepreneurs are growth driven, was reinforced when, in over half of the cases, we observed an element of necessity underlying business creation of new business activities. In approximately a quarter of the cases, the strongest pull factors comprised various resources, active pursuit, and intentions. In nine out of ten cases, the strengths comprising competitive advantage were resources. This indicates that pluriactive farm business activities are rarely primarily based on partnership, quality, market competence, or market contacts. However, growth intentions related to pluriactive farm business activities helped in dividing enterprises and entrepreneurs into various categories. By categorizing the farm firms according to their growth intentions, observing the reasons for their chosen growth strategies becomes possible. A deeper awareness of the grass-root level growth strategies will both enhance our understanding of entrepreneurial behavior and of how growth becomes possible through entrepreneurial action.

Our second hypothesis - pluriactively growth-oriented family farm entrepreneurs base their strategies on individual skills and capabilities, was reinforced by the result that shows approximately a quarter of the farms are already established entrepreneurs with extensive pluriactive operations based mainly on the resources provided by the farm firm. Slightly over onethird of them are growth driven, and a quarter are small-scale or initial stage experimenters. The rest (approximately 13%) are at some kind of a stand-still or problem stage. The strong orientation towards pluriactivity in recent years was mainly explained by the nature of and commitment required by current operations, systematic pursuit, and a drive for change. The nature of the initial motives and strengths for engaging in pluriactive farm business activities was generally (statistically) connected with the entrepreneurs’ approaches to growth and their specific growth orientation. Our results support the findings of Ferguson and Olofsson (2011) that although farmers felt a necessity to create new business, they had two different logics of departure: the logic of leverage, which focuses on reconfiguring existing resources, and the logic of opportunity, where the focus was on recognizing external opportunities.

Our results also indicate that growth-driven farms did not in any particular way diverge from all other farms engaged in pluriactive farm businesses. Therefore, it is possible that a high percentage of farms engaged in pluriactive activity could commit to growth. Another conclusion, based on our proxy statement of family essence approach, is that entrepreneurs’ family members may affect entrepreneurs’ growth intentions, and that an entrepreneur family’s own perception of their orientation (i.e., their intention) largely dictates the extent of their growth drive. Growth, therefore, can be influenced by clarifying intentions, that is, by fostering internal growth and awareness of one’s own strengths. Our third hypothesis, Entrepreneurial orientation affects the growth of family farm firms and their renewal via pluriactivity, was reinforced by the result that shows proxy statement of family essence approach is connected to growth intentions and functional renewal of family farm firms. Namely, pluriactivity as a form of growth contributes to the family business essence approach. Our findings support Basco’s (2013) finding that the strategic decision-making is influenced by those family members who were working actively on pluriactive farm firms.

However, our findings also suggest that the influence of those family members who are not actively working (e.g., spouses) on the farm might appear in the strategic decision-making. We suggest that family farm firms high in these factors might be more likely to use pluriactivity as a growth strategy. Furthermore, our findings are in line with Grande et al. (2011a, 2001b), which considers a variety of development paths in family farm firms and suggests the importance of entrepreneurial skills in developing new farm-based ventures

Our study contributes to the research on family business growth strategies by demonstrating that one family-oriented goal could be to let the family members choose their own paths beyond the family firm but instead of leaving them alone on their chosen path, seek to involve them in the business by diversifying the business according to the family member’s interests. We suggest that pluriactivity can be seen as a form of strategic orientation, namely a growth strategy of family farm firms (Astrachan, 2010; Miller, Le Breton, and Lester, 2013)

Our research contributes to the prior literature on family firms and their growth strategies in various ways. We have examined family firms that have a great impact on local and global economy and well-being. This study demonstrates also the influence on family ownership because family farm firms’ governance are often motivated by both social (non-economic) and economic outcomes (Zahra, 2007; Gomez-Mejia, Haynes, Nunez-Nickel, Jacobson, and Moyano-Fuentes, 2007; Berrone, Cruz, and Gomez-Mejia, 2012; Ducassy, and Prevot, 2010), and thus we agree that a farm’s growth and value cannot be measured by monetary terms only (Smith and Mc Elwee, 2013) while pluriactivity is perceived as a strategy. Strategic orientation as a perspective for qualitative growth and renewal may increase the visibility of the micro-level aspects of entrepreneurship, as stated to understand what drives entrepreneurs, namely family farmers in entrepreneurial action at the micro-level. (Davidsson and Wiklund, 2013; Zahra, 2007) but also in the level of family businss groups (Piana, Vecchi, and Cacia, 2012). Though scholars (Basco, 2013; Basco and Rodriquez, 2009) have begun to more finely examine the contribution of family governance to business success, additional studies should examine the role of these interventions, collectively, in sustaining family distinctiveness (Graig, Dibrell, and Garrett, 2013). Graig et al., (2013) point out that family owned or family influenced family businesses have been noticed to be different compared to other businesses. Especially tacit knowledge, transmitted among the family, has been recognized as a strategic asset in family firms. These kinds of strategic assets are unique and difficult to imitate but they also have the potential to be utilized as a competitive advantage.

Implications for practice

This study has several implications for family business management and policymakers. Our study has revealed that family firms need support for both exploring and exploiting their opportunities for growth and renewal, that is, they need support for pluriactive businesses. Our study may also help policymakers support family farm firms in a more targeted manner.

The established group could receive tailored business training, consultancy, and development projects (e.g., quality, cooperation, product development), which would help the family farm firms to reinforce the competitive ability and advantage of their pluriactive businesses.

The growth-driven group needs to be encouraged to grow as entrepreneurs by influencing their strategic thinking and by helping to clarify their intentions. Because intentions significantly steer growth, family business management consultants and policymakers, perhaps in cooperation, could offer, instead of only capital or production- and business-related training, strategic expertise to growth-driven family farm firm entrepreneurs as means to clarify their future business plans. The experimenters group must often decide on the strategic choices they want to take. They should be provided mainly with critical external assessment help as a basis for their future planning solutions. The stand-still entrepreneurs often require some kind of reorganization, for example in diversifying their competitiveness, identifying growth opportunities, or in finding an applicable method of discontinuing operations.

Limitations and paths for future research

Our study is not without limitations. We revisited the previously collected quantitative data and consider the results to be merely suggestive. Our focus was also limited to pluriactive family farm firms in Central Finland. Nevertheless, the results can be cautiously generalized to the whole country because we included production branch, farm size, age, education, regional type, and other similar characteristics as cluster analysis variables. Our sample’s small size and geographical limitations might cause method bias. We compared our sample with larger national studies and found our family farm firms to be representative of family farm firms in the country as a whole, both in the extent of their pluriactivity and in their size.

Sharma and Sharma (2011) argue that, based on Ajzen’s (1991) theory of planned behavior, “dominant coalitions in firms with higher levels of family involvement in business are more likely to have stronger intentions to pursue a PES.” We were interested in seeing if pluriactivity and diversified incomes could be regarded as planned behavior in family farm firms. By dividing the respondents into groups according to their willingness to grow, we ended up with groups that were differentiated from each other.

For future research, it is important to develop a further understanding of farms’ functional strengths. We might accomplish this by incorporating the different concepts of capital—economic, human, social and psychological— into the data acquisition. This method could generate ideas for practical development. Qualitative growth should be carefully reviewed and defined because growth models do not necessarily cover these variables, which do not seem to exist in the analyses yet (Davidsson and Wiklund, 2013; Chrisman et al., 2012). For family firms it is even more important to notice that the performance of a firm may depend on individual capabilities and resources and on the entrepreneur’s abilities to facilitate them effectually into business as our sample of family farms illustrated when contextualizing growth strategies and renewal.

Instead of extrinsically given strategies and forced plans, farmers could also benefit from slowly emerging and coherent strategies (Hurst, 2002; Webb, et al., 2010). However, more information is needed about the role of family involvement in shaping strategic entrepreneurship and the probable differences between family-owned and family-influenced firms. We suggest that further research is needed about family business strategies and the performance of business outcomes, but also about failures of growth strategies.

References

- Agarwal, R. & Helfat, C.E. (2009). Strategic Renewal of Organizations. Organization Science, 20(2), 281-293.

- Ajzen, I. (1991). The Theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179-211.

- Ajzen, I. (2001). Nature and Operation of Attitudes. Annual Review of Psychology, 52, 27-58.

- Ajzen, I. & Fishbein, M. (1980). Understanding Attitudes and Predicting Social Behavior. New Jersey: Englewood Cliffs, Prentice Hall.

- Alsos, G.A., Carter, S., Ljunggren, E. & Welter, F. (2011). The Handbook of Research on Entrepreneurship in Agriculture and Rural Development. Northampton, MA: Edward Elgar Publishing.

- Arregle, J-L., Naldi, L., Nodqvist, M. & Hitt, M.A. (2012). Internationalization of Family-Controlled Firms: A Study of the Effects of External Involvement in Governance. Journal of Family Business Strategy, 36(6), 1115-1143.

- Astrachan, J.H. (2010). Strategy in family business: Toward a multidimensional research agenda. Journal of Family Business Strategy, 1(1), 6-14.

- Astrachan, J.H. & Jaskiewicz, P. (2008). Emotional Returns and Emotional Costs in Privately Held Family Businesses: Advancing Traditional Business Valuation. Family Business Review, 21(2), 139-149.

- Astrachan, J.H., Klein, S.B. & Smyrnios, K.X. (2002). The F-PEC Scale of Family Influence: A Proposal for Solving the Family Business Definition Problem. Family Business Review, 15(1), 45-58.

- Astrachan, J.H. & Shanker, M. (2003). Family Business Contribution to the U.S. Economy: A Closer Look. Family Business Review, 16(3), 211-219.

- Barbera, F. & Hasso, T. (2013). Do We Need to Use an Account? The Sales Growth and Survival Benefits to Family SMEs. Family Business Review, 26(3), 271-292.

- Basco, R. (2013). The family’s effect on family firm performance: A model testing the demographic and essence approaches. Journal of Family Business Strategy, 4(1), 42-66.

- Basco, R. & Rodriquez, M.J.P. (2009). Studying the Family Enterprise Holistically Evidence for Integrated Family and Business Systems. Family Business Review, 22(1), 82-95.

- Basco, R. & Rodriquez, M.J.P. (2011). Ideal types of family business management: Horizontal fit between family and business decisions and the relationship with family business performance. Journal of Family Business Strategy, 2(3), 151-165.

- Bellu, R.R. & Sherman, H. (1995). Predicting business success from task motivation and attributional style: a longitudinal study. Entrepreneurship and Regional Development, 7(4), 349-363.

- Berrone, P., Cruz, C. & Gomez-Mejia, L.R. (2012). Socio-emotional Wealth in Family Firms Theoretical Dimensions, Assessment Approaches, and Agenda for Future Research. Family Business Review, 25(3), 258-279.

- Bird, B. (1988). Implementing Entrepreneurial Ideas. The Case of Intention, Academy of Management Review, 13(3), 442-453.

- Bird, B. (1992). The Operation of Intentions in Time: The Emergence of the New Venture. Entrepreneurship Theory and Practice, 17(1), 11-27.

- Boyd, B.& Hollensen, S. (2012). Strategic management of a family-owned airline: Analyzing the absorptive capacity of Cimber Sterling Group A/S. Journal of Family Business Strategy, 3(2), 70-78.

- Brannon, D.L., Wiklund, J. & Haynie, J.M. (2013). The Varying Effects of Family Relationships in Entrepreneurial Teams. Entrepreneurship Theory and Practice, 37(1), 107-132.

- Brewton, K.E., Danes, S.M., Stafford, K. & Haynes, G.W. (2010). Determinants of rural and urban family firm resilience. Journal of Family Business Strategy, 1, 155-166.

- Chandler, G.N., McKelvie, A. & Davidsson, P. (2009). Asset specificity and behavioral uncertainty as moderators of the sales growth — Employment growth relationship in emerging ventures. Journal of Business Venturing, 24(4), 373-387.

- Carter, S. (1998). Portfolio entrepreneurship in the farm sector: Indigenous growth in rural areas?, Entrepreneurship and Regional Development, 10(1), 17-32.

- Casillas, J.C., Moreno, A.M. & Barbero, J.L. (2010). A configurational approach of the relationship between entrepreneurial orientation and growth of family firms. Family Business Review, 23(1), 27-44.

- Chrisman, J.J., Steier, L.P. & Chua, J.H. (2008). Toward a theoretical basis for understanding the dynamics of strategic performance in family firms. Entrepreneurship Theory and Practice, 32(6), 935-947.

- Chrisman, J.J. Chua, J.H. & Sharma, P. (2005). Trends and Directions in the Development of a Strategic Management Theory of the Family Firm. Entrepreneurship Theory and Practice, 29(5), 555-576.

- Chrisman, J.J., Chua, J.H., Pearson, A.W. & Barnett, T. (2012). Family Involvement, Family Influence, and Family-Centered Non-Economic Goals in Small Firms. Entrepreneurship Theory and Practice, 36(2), 267- 293.

- Coleman, S. & Carsky, M. (1999). Sources of Capital for Small Family-Owned Businesses: Evidence from the National Survey of Small Business Finances. Family Business Review, 12(1), 73-84.

- Collis, D.J. & Montgomery, C.A. (1997). Corporate Strategy. Resources and the Scope of the Firm. Boston: Irwin McGraw-Hill.

- Covin, J.G. & Slevin, D.P. (1989). Strategic management of small firms in hostile and benign environments. Strategic Management Journal, 10(1), 75-87.

- Covin, J.G. & Slevin, D.P. (1990). New venture strategic posture, structure, and performance: An industry life cycle analysis. Journal of Business Venturing, 5(2), 123-135.

- Covin, J.G., & Slevin, D.P. (1991). A Conceptual Model of Entrepreneurship as Firm Behavior. Entrepreneurship Theory and Practice, 16(1), 7-25.

- Davidsson, P. & Wiklund, J. (Eds.) (2013). New Perspectives on Firm Growth. Cheltenham, UK: Edward Elgar Publishing.

- Delmar, F. (1997). Measuring Growth: Methodological Considerations and Empirical Results. In R. Dunkels. & A.Miettinen (Eds.), Entrepreneurship and SME Research: On its Way to the Next Millenium. Ashgate, UK: Aldershot.

- Delmar, F., Davidsson, P. & Gartner, W.B. (2003). Arriving at the high-growth firm. Journal of Business Venturing, 18(2), 189-216.

- De Silva, L.R. & Kodithuwakku, S.S. (2011). Pluriactivity, entrepreneurship and socio-economic success of farming households. In G.A. Alsos, S. Carter, E. Ljunggren, & F. Welter (Eds.), The Handbook of Research on Entrepreneurship in Agriculture and Rural Development (pp. 38-53). Northampton, MA: Edward Elgar Publishing.

- Ducassy, I. & Prevot, F. (2010).The effects of family dynamics on diversification strategy: Empirical evidence from French companies. Journal of Family Business Strategy, 1(4), 224-235.

- Eddleston, K.A., Kellermanns, F.W. & Zellweger, T.M. (2012). Exploring the Entrepreneurial Behavior of Family Firms: Does the Stewardship Perspective Explain Differences? Entrepreneurship Theory and Practice, 36(2), 347-367.

- Eddleston, K.A., Kellermanns, F.W., Floyd, S.W., & Crittenden, V.L. & Crittenden, W.F. (2013). Planning for Growt: Life Stage Differences in Family Firms. Entrepreneurship Theory & Practice, 37(5), 1177-1202.

- Eikeland, S. (1999). New Rural Pluriactivity? Household Strategies and Rural Renewal in Norway. Sosiologia Ruralis, 39, 359-376.

- Frank, H., Lueger, M., Nose, L. & Suchy, D. (2010). The concept of “Familiness”. Literature review and systems theory-based reflections. Journal of Family Business Strategy, 1(3), 119-130.

- Ferguson, R. & Olofsson, C. (2011). The Development of new ventures in farm businesses. In G.A. Alsos, S. Carter, E. Ljunggren, & F. Welter (Eds.), The Handbook of Research on Entrepreneurship in Agriculture and Rural Development (pp. 21-37). Northampton, MA: Edward Elgar Publishing.

- Fishbein, M. & Ajzen, I. (1975). Belief, Attitude, Intention and Behavior: An Introduction to Theory and Research. Reading: MA: Addison-Wesley.

- Friar, J.H. & Meyer, M.H. (2003). Entrepreneurship and Start-Ups in the Boston Region: Factors Differentiating High-Growth Ventures from Micro-Ventures. Small Business Economics, 21, 145-152.

- Gallo, M.A. & Vilaseca, A. (1998). A Financial Perspective on Structure, Conduct, and Performance in the Family Firm: An Empirical Study. Family Business Review, 11, 35-47.

- Goel, S., Mazzola, P., Phan, P.H., Pieper, T.M. & Zachary, R.K. (2012). Strategy, ownership, governance, and socio-psychological perspectives on family businesses from around the world. Journal of Family Business Strategy, 3(2), 54-65.

- Gomez-Mejia, L.R., Haynes, K.T., Nuñez-Nickel, M., Jacobson, K.J.L. & MoyanoFuentes, J. (2007). Socio-emotional Wealth and Business Risks in Familycontrolled Firms: Evidence from Spanish Olive Oil Mills. Administrative Science Quarterly, 52, 106-137.

- Graig, J.B., Dibrell, C. & Garrett, R. (2013). Examining relationships among family influence, family culture, flexible planning systems, innovativeness and firm performance. Journal of Family Business Strategy, http://dx.doi. org/10.1016/j.jfbs.2013.09.002.

- Grande, J. (2011a). Entrepreneurial efforts and change in rural firms: three case studies of farms engaged in on-farm diversification. In G.A.Alsos, S.Carter, E.Ljunggren, & F.Welter (Eds.), The Handbook of Research on Entrepreneurship in Agriculture and Rural Development (pp. 74-93). Northampton, MA: Edward Elgar Publishing,

- Grande, J. (2011b). New venture creation in the farm sector – Critical resources and capabilities, Journal of Rural Studies, 27, 220-233.

- Grande, J., Madsen, E.L. & Borch, O.J. (2011). The relationship between resources, entrepreneurial orientation and performance in farm-based ventures. Entrepreneurship and Regional Development, 23, 89-111.

- Habbershon, T.G. & Williams M.L. (1999). A Resource-Based Framework for Assessing the Strategic Advantages of Family Firms. Family Business Review, 12(1), 1-15.

- Hill, B. (2000) Farm incomes, wealth and agricultural policy. Aldershot: Ashgate Publishing.

- Holt, D.T. (2012). Strategic Decisions Within Family Firms: Understanding the Controlling Family’s Receptivity to Internationalization. Entrepreneurship Theory and Practice, 36(6), 1145-1151.

- Hurst, D.K. (2002). Crisis & Renewal: Meeting the Challenge of Organizational Change. Boston: Harvard Business School Press.

- Ifera, 2003. International Family Enterprise Research Academy (IFERA). Family Business Review, 16(4), 235-240.

- Jervell, A.M. (1999). Changing Patterns of Family Farming and Pluriactivity. Sociologia Ruralis, 39(1), 110-116.