Dawid Szutowski, PhD candidate, Poznan University of Economics, Faculty of International Business and Economics, Department of Tourism, Al. Niepodległości 10, 61-875 Poznań, Poland, This email address is being protected from spambots. You need JavaScript enabled to view it..

Marlena A. Bednarska, PhD, Poznan University of Economics, Faculty of International Business and Economics, Department of Tourism, Al. Niepodległości 10, 61-875 Poznań, Poland, This email address is being protected from spambots. You need JavaScript enabled to view it..

Abstract

Innovations seem crucial for contemporary enterprises willing to achieve the objective of increasing firm’s value. The aim of this paper is to examine, both conceptually and empirically, the relationship between innovations and tourism enterprises’ market value. Tourism sector was taken into consideration in order to fulfill the existing research gap. This focused paper was based on relevant market data. Event study and calendar time portfolio approaches were chosen to test investors’ responses to innovation announcements. Six tourism companies listed on the Main Market of Warsaw Stock Exchange were examined within the six years research period and 34 innovation announcements were identified. Polish Press Agency database and Warsaw Stock Exchange databases were used to collect data. Results indicate that innovations affected positively investors’ valuation of tourism enterprises. The average event day market value change equaled 0.63% and differed considerably from the one-year one of 3.02% meaning that investors adjust their initial reaction over time. Initially investors reacted mostly to marketing, distributional and external relations innovations while within one-year period they attributed the most value to marketing and external relations ones.

Keywords: innovation, market value, event study, calendar time portfolio, tourism enterprise.

Introduction

There is only one thing that is constant nowadays, that is constant change (Gunday, Uluso, Kilic, Alpkan, 2011). Issues concerning innovations are strongly related to the current worldwide scientific discussion and stem from such domains as: innovation driven economy, knowledge economy and neo-Schumpeterian economics. They are also key factors in OECD and EU policies. Moreover, innovations are crucial at the enterprise level (Janasz and Kozioł, 2007) as all enterprises operating in a contemporary market expose themselves to innovations (Ciborowski, 2003; Gunday et al., 2011). Also innovations represent the most significant component of a company’s strategy as they provide directions for the firm’s evolution (Siguaw, Enz, Kimes, Verma, Walsh, 2009). All these characteristics of innovations apply also to tourism enterprises, especially in the European Union, where tourism is considered to be an important contributor to the economy and one of motors of future growth (WTTC, 2014). In this context research concerning innovations with respect to tourism enterprises remains crucial.

At the same time market value increase seems to be the most important goal for every company (Copeland, Koller and Murrin, 1997). Growing companies stimulate employment, are able to discharge liabilities and offer trade credit to their customers (Rappaport, 1998). A company’s value is also the best measure of its performance (Szablewski and Tuzimka, 2004). The purpose of market value increase is emphasized in companies where owners hire managers. In such situation both groups represent their own, differing goals (Wilimowska, 2008). However establishing the maximization of market value as company’s goal allows their goals to approach one another or overlap (Szczepankowski, 2007). The issue of market value is vital for listed companies as they commonly deal with stock prices. The increase in value is determined on the market and reflected through investors’ offerings.

In the light of the above discussion what seems especially important is the relationship between innovations and market value of tourism companies listed on European stock exchanges. This issue will constitute the axis of the present paper, which is structured as follows. The first section discusses innovations in the tourism industry and delivers research hypotheses. Then methodology and data sources are presented. Findings of the study on shortand long-term effects of innovations in tourism enterprises are presented in the third section of the paper. Finally, implications and recommendations for future research are proposed and main conclusions are summarized.

Literature review and research hypotheses

The growing recognition of services as the core of the process of structural change in modern economy has resulted in a proliferation of research on innovations in this sector. As noted by Carlborg, Kindström and Kowalkowski (2014), service innovation is no longer considered a side activity to product innovation; it constitutes a research field in its own right. However, the progress made by investigators regarding innovative practices and their consequences for firm performance in the service context has not been transferred with equal intensity to the tourism sector (Camisón and Monfort-Mir, 2012; Williams and Shaw, 2011). The present study, therefore, aims to address this gap and seeks to contribute by recognizing effects of innovations on tourism companies’ market value.

A substantial body of contemporary innovation research has been built on Schumpeterian approach (1934). In Schumpeter’s theory economic development is driven by innovations, defined as new combinations of means of production. These new combinations refer to a new product or a new quality of a product; a new method of production; a new market; a new source of supply; and a new organization of industry. Proponents of the synthesis perspective on service innovation research find Schumpeter’s concept to be broad enough to encompass both service and manufacturing innovations (Drejer, 2004). Still it is advisable to display specific characteristics that make innovations in tourism significantly different in type and in adoption processes from innovations in manufacturing settings. According to Hall and Williams (2008) four distinctive features of tourism innovations should be taken into account and these are:

- The co-terminality of tourism service production and consumption – tourists are active collaborators in encounters with service providers, hence they can become co-creators of innovations.

- Information intensity – the tourism industry is heavily reliant on information exchanges, which stimulates developing and implementing IT innovations.

- The importance of the human factor – there is a constant tension between managing labor costs and labor quality in tourism, which leads to intensifying intra-firm organizational innovations.

- The critical role of organizational factors – tourist experience is made up of multiple encounters with different service providers, in consequence inter-firm organizational innovations grow in importance.

In the present study the broad concept of innovation is applied, which is consistent with Schumpeterian perspective. Innovation refers to the process of generation, development and implementation of ideas or behaviors new to adapting organization. A new idea or behavior may pertain to a product, service, technology, structure, system, or practice (Damanpour, 1996).

Innovations can take a wide variety of forms and can be classified in different ways. Perhaps the most common approach to categorization of innovations stems from Oslo Manual (OECD and Eurostat, 2005). It defines four types of innovations at the level of the firm that encompass a wide range of changes involving new or significantly improved solutions: product, process, organizational, and marketing innovations. In tourism research Hjalager (2010) applies a categorization close to Schumpeter’s original one and analyses five types of innovations: product (service), process, managerial (organizational), management (marketing), and institutional innovations. Distributional innovations can be considered as a part of process innovations (Weiermair, 2004), however given the critical role of distribution channels in tourism marketing it seems suitable to classify them as a separate category (Nicolau and Santa-María, 2013). Due to the complex and networked characteristics of the tourism product (Pikkemaat and Peters, 2005) and growing recognition of the significance of external knowledge in developing innovative capabilities (Saunila and Ukko, 2012) it seems essential to include inter-organizational relations in innovation analysis.

Based upon the above arguments a modified typology of innovations has been proposed in the paper:

- Product (PROD) – components, user- friendliness, functional characteristics, technical specifications etc.

- Process (PROC) – equipment, software, techniques etc.

- Management (MGMT) – staff empowerment, job profiles, authority systems, collaborative structures etc.

- Marketing (MKTG) – promotion, pricing, design, packaging etc.

- Distribution (DISTR) – intermediaries, distribution channels etc.

- External relations (EXT REL) – collaboration with research organizations, relations with other firms and institutions, integration with suppliers etc.

- Institutional (INST) – destination management systems, financing accessibility, control over the access to vulnerable areas etc.

In recent years innovative practices in tourism have received an increasing attention in academic literature. Although it is generally recognized that tourism organizations function in an extremely competitive sector, which causes the innovative activity to be a prerequisite for their successful operation and survival, empirical evidence of effects of innovation has been marginal (Hjalager, 2010). Furthermore, little research has linked innovations to objective business performance measures.

Ottenbacher (2007), who studied success factors of innovations in the hospitality industry in Germany, found that new service development was positively linked to market performance, financial performance and employee and customer relationship enhancement, all dimensions being subjectively evaluated by managers. In their investigation of small and medium-sized tourist enterprises in Greece, Petrou and Daskalopoulou (2009) identified positive relationship between the decision to adopt an innovation and the firm’s growth prospects approximated by expected employment increase in the next five-year period. Grissemann, Plank and Brunner-Sperdin (2013) investigated the interplay between customer orientation, innovation, and business performance in the Alpine lodging industry. Using perceptual measures they concluded that innovation behavior of hotels positively influenced financial performance, customer retention, and reputation. Orfila-Sintes and Mattsson (2009), in their research of determinants and outcomes of innovation behavior in the hotel industry in Spain, reported there was the lagged effect of innovation on performance measured as the average occupancy rate. In their study of innovation–performance relationship in Spanish hotels, Nicolau and Santa-María (2013) analyzed market value as a firm performance indicator and found that innovations yielded an increase in stock exchange returns.

Overall, empirical research adopts either a subjective or an objective approach towards measuring effects of innovations in the tourism industry, the latter being less frequently used. For that reason the present study concentrates on enterprise market value. For listed companies market value is reflected through stock prices determined in investors’ sell and buy offers. In line with the efficient market hypothesis - the information efficiency of financial markets is assumed, thus stock prices reflect all available information (Fama, 1970). Among other qualities market value is the most up-to-date and precise measure of company performance (Milburn, 2008). First, it changes every time new information hits the market. Second, it represents a market consensus of multiple investors’ valuations that is especially important while single investor valuation undergoes erroneous beliefs and tastes for assets as consumption goods biases (Fama and French, 2007).

Innovations are presumed to have positive influence on tourism enterprises market value. Potential benefits from innovations’ implementation change investors’ predictions of future cash flows resulting in stock price increase. Thus the first hypothesis is stated as follows:

H1: Innovations influence positively investors’ perception of the company’s future cash flows reflected through the company’s market value.

Investors perceive different innovation types differently because they influence diverse fields of companies operations and differ in costs and potential profits. Therefore the second hypothesis is expressed in the following statement:

H2: Different types of innovations influence tourism companies’ market value differently.

The consecutive result of innovations’ diversity is their sophistication resulting in considerable time investors need to recognize their potential effects. Furthermore different innovation types can entail different information policies conditioning investors’ adjustments in time of their initial reactions. Hypothesis three is presented as follows:

H3: Investors’ initial reactions to different types of innovations can be adjusted over a long period of time.

H1 is set against the nulls that markets will not respond to innovation announcements, H2 against the one that the market does not distinguish between innovation types, and H3 against the one that investors incorporate new information fully in the stock prices at the appearance of innovation announcement. The three hypotheses will be tested with the use of methods described in the following section.

Research methods

To test the proposed hypotheses empirically data on tourism enterprises listed on the Main Market of Warsaw Stock Exchange – WSE was used. Polish exchange holds the regional dominant position by slightly outranking Central and Eastern Europe Stock Exchange Group - CEESEG (Szutowski, 2014). On the Main Market it trades eight tourism companies among which there are: three gastronomic ones – Amrest holding, Mex Polska and Sfinx Polska; two hotel companies – Interferie and Orbis; and one of each: casino – Olympic Entertainment Group, tour operator – Rainbow Tours, ski operator – Tatry Mountain Resort. MEX Polska and Tatry Mountain Resort undertook theirs IPOs in May and October 2012 respectively and due to insufficient data they were excluded from further research. All companies chose Main List (instead of MTF platform - NewConnect), and PLN as listing currency. There is no index dedicated to tourism enterprises on WSE.

The time scope was determined as 2008 – 2013 due to empirical evidence from previous research. Mitchell and Stafford (2000) used the period of 3 years to capture the event’s effects on stock price performance. Nicolau and Santa-Maria (2013) in their study on innovation’s effect on hotel market value observed inter alia the longest period with no innovation announcement surpassing slightly 2 years. In this period 34 innovation announcements were identified for the whole sample

One of the examples of product innovations could be the introduction of figlokluby.pl by Rainbow Tours, the on-line service designed for tourists to meet their companions before the actual trip. The information was released on 17th November, 2012. One of the announcements concerning process innovations, released on 20th April, 2012 by Olympic Entertainment, proclaimed the launch of the pilot project for Cloud solutions in on-line gaming. The pieces of information on management innovations, released by Orbis on 12th April, 2012 was that the company introduces the generation diversity management program in order to ensure an increased level of mutual understanding among the workers. In order to personalize effectively offers and promotions Rainbow Tours introduced a system that tracks user movements on the website. Such announcement referring to that marketing innovation was released on 30th August, 2012. The example of a new distribution channel is the reception of on-line license for Olympic Entertainment, which was the first to introduce the advanced platform for on-line gaming. Such information was announced on 16th July, 2013. The example of innovative external relation was the joint introduction of postgraduate studies designed for hotel staff by Orbis and the University of Łódź. The information was released on 15th May 2012.

In order to study the relationship between innovations and tourism enterprise market value two different approaches were applied: event study to determine short-term investors’ reaction to innovation announcements and calendar time portfolio to assess the long-term one. Both will be consecutively described in details.

Event study method is used to measure financial effects of unanticipated events and it allows assessing whether there are abnormal stock price changes associated with them (McWilliams and Siegel, 1997). The usefulness of such an approach comes from the fact that such an event will be reflected immediately in security prices (MacKinlay, 1997). Thus, the abnormal return provides an estimate of the future earnings generated by the event (Geyskens, Gielens and Dekimpe, 2002). In the present study the event of interest is publicly available innovation announcement made by companies under investigation.

The innovation announcements (press releases) were chosen to represent innovations basing on several assumptions. First, the announcements are relevant, and they contain full and true information about the innovations. Second, they concern innovations with significant impact on market value, thus are incorporated by investors in the moment of press release. Third, the new information comprises all necessary information for investors to predict future market value change due to innovation. In the moment of the press release the factual change of company’s cash flows due to innovation is unknown.

Assessment of the event’s effect requires a measurement of the abnormal (excess) return over the event window – the period over which the stock price fluctuations will be examined. It is typical to determine the event window to be larger than the day of the release of innovation announcement. This permits examination of pre- and post-event stock price changes due to leakage and dissemination effects (Geyskens et al., 2002). In the present study eleven windows were examined ranging from 1 to 21 days (10 preevent days, the event day and 10 post-event days).

In line with McWilliams and Siegel (1997) every event window was checked for confounding announcements such as: declaration of dividends or earnings, mergers and acquisitions, equity offering, change in key executives. Such financially relevant events unrelated to innovation could seriously reduce validity of the empirical results, as it would be difficult to isolate the impact of one particular event. Due to the procedure no announcements were eliminated. In present research only announcements were taken into consideration, all kinds of preannouncements signaling future actions concerning innovations were neglected.

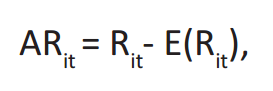

Central to event study approach is calculating abnormal returns, which are assumed to reflect the stock market’s reaction to new information arrival (McWilliams and Siegel, 1997). The abnormal return is the difference between the actual return and the expected return that would have occurred if the event had not taken place:

where ARit, Rit and E(Rit) are abnormal, actual and expected returns respectively for firm i on day t.

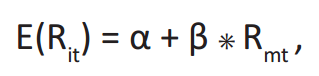

Expected returns were computed using market model, which assumes a linear relation between the security return and the market return:

where Rmt is the return on the stock market index on day t (in the present study – WIG, Warsaw Stock Exchange Index) and α and β are the parameters estimated from a least squares regression of Rit on Rmt over the estimation period of 250 days before the announcement.

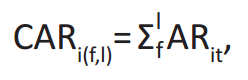

The daily abnormal returns were aggregated over the event window and cumulative abnormal returns were calculated as follows:

where CARi(f,l) is cumulative abnormal return for firm i over the event window L (horizon length) equalling l – f +1 (Eckbo, 2007) and f and l are first and last days of the event window respectively.

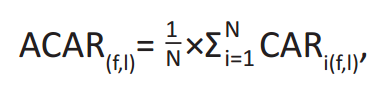

Lastly, to obtain a single CAR for different innovation types and for the whole sample an average of all event-specific CARs was computed:

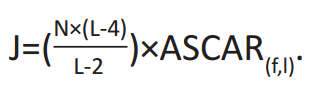

where ACAR(f,l) is average cumulative abnormal return over the event window and N is a number of observations (in the present study – a number of innovation announcements).

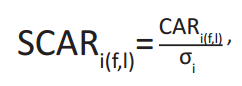

In order to verify the results’ statistical significance the J test was used (Szyszka, 2003). The test is based on standardized cumulative abnormal returns determined as:

where SCARi(f,l) is standardized cumulative abnormal return for firm i and σi is estimate of standard deviation of firm’s i CAR calculated over the event window.

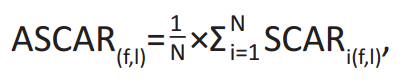

The next step in performing the test is the calculation of average standardized cumulative abnormal return that represents arithmetic mean of all observations:

where ASCAR(f,l) is average standardized cumulative abnormal return over the event window.

It is assumed that SCARi(f,l) follows a t-Student distribution with L-2 degrees of freedom. In present test the null hypothesis is that an event doesn’t influence the stock prices. Null hypothesis is tested through the following statistic:

Statistical significance was tested for 0.05 and 0.1 α-values

Before introducing a calendar time portfolio approach an important limitation of event study should be indicated. Applying event study approach to measure long-term effect of innovations (e.g. one-year period) results in significant overlaps between different event windows and causes crosssectional correlations among different abnormal returns. Standard errors are biased towards zero, inflating t-statistics and misleading statistical inference (Mitchell and Stafford, 2000). In this case overlapping events occurring in one company share common measurement period, overlapping events from different companies are influenced by same industry and market events.

Calendar time portfolio is used to assess long-term events’ effects. The approach is based on creating one hypothetic portfolio from stocks of studied entities (all stocks are equally weighted). Shares are added to the portfolio gradually, when consecutive events occur (Seasholes and Zhu, 2010), held for a predetermined period, and removed (Sorescu, Shankar and Kushwaha, 2007). In present research after an event occurs the company’s shares are added to the portfolio for one year. A single abnormal return measure for the entire sample is calculated on the monthly basis. Mitchell and Stafford (2000) advocate such approach strongly due to that all event-firm abnormal return cross-correlations are accounted for in the portfolio variance. In present research events are represented by publicly available announcements.

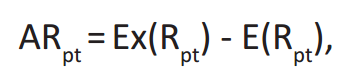

Calendar time portfolio procedure consists of three stages. First, the portfolio is constructed and the factual return is measured. Second, the expected return is calculated using an economic model. Third, one abnormal return is calculated for the whole sample. The abnormal return is calculated as the difference between excess return and the expected return.

where ARpt is abnormal return of portfolio p during month t, Ex(Rpt) stands for excess return of portfolio p in month t, and E(Rpt) is the expected return of portfolio p in month t.

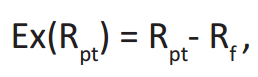

The excess return is calculated as the difference between factual return and the risk free rate of return.

where Rpt is factual rate of return of portfolio p in month t, and Rf is the risk free rate of return.

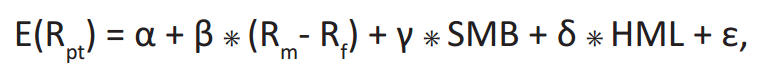

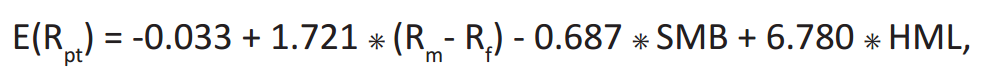

In order to calculate expected returns three-factor model was used. In three-factor model the expected return is calculated as a function of overall market returns, size, and book to market ratio with the use of following formula:

where E(Rpt) is the expected return of portfolio p during month t, Rm stands for market return, SMB represents small minus big (difference between returns of small and large firm stocks), and HML is the high minus low (the difference between returns of high and low book-to-market stocks), α is the model’s intercept, β, γ, δ are parameters of the three factors, ε is the error term.

In present research Fama and French three-factor model was chosen to calculate expected returns, because it surpasses the capital asset pricing model (CAPM). The intercept and the three parameters (β, γ, δ) were estimated with the use of linear regression. The estimation period preceded the verification period and lasted for 12 months. Market return were represented by WIG – WSE main index.

The final equation for calculating expected returns took a form of:

The prediction model was statistically significant, F (3, 7) = 5.58, p<.05, and accounted for approximately 70% of the variance of expected returns (R2=.70, Adjusted R2=.58).

Necessary data concerning stock prices and WIG were collected from Warsaw Stock Exchange database and directly form companies’ websites. Risk free rate of return as well as SMB and HML ratios are published in “Fama/French European Factors” section on Kenneth R. French website (French, 2014). Data referring to innovations was obtained through Polish Press Agency official database and companies websites.

Results and discussion

The results of the analysis are divided into short-term and long-term ones and presented consecutively. First part leads to positive verification of H1 and H2, while the second part holds H3.

Short-term analysis is reported in Table 1, which presents cumulative abnormal returns averaged across 34 observations for multiple periods. In general, the investigation revealed that investors’ reactions to innovation announcements made by tourism enterprises were mostly positive. In eight out of eleven event windows under consideration actual returns were greater than expected returns; in three remaining windows the opposite was the case. Further analysis showed that abnormal returns were significantly different from zero at the 5% significance level in half of examined intervals; in most cases the differences were positive. It appears that, on average, the stock market recognized innovation announcement value, thus hypothesis 1 can be confirmed.

The findings indicate that firms developing innovations experienced 0.63% abnormal returns on the event day. Of all windows surrounding the event day, the one from -5 to +5 showed the highest (and statistically significant) ACAR, with a value of 2.00%. The findings are partially consistent with the research of Nicolau and Santa-Maria [2013]. Authors calculated the event-day abnormal return at the level of 0.64% and the +/- 5 days AR equaling 0.83%. The shorter event windows were tested by Sood and Tellis [2009]. The authors reported event-day abnormal return at the level of 0,40% and the AR for +/-1 and +/-2 event windows both equaling 0,50%.

| Windows | ACARs | J-values |

|---|---|---|

| Event day | 0.63% | 1.96** |

| +/-1 | 0.37% | 1.06 |

| +/-2 | 0.32% | 4.33** |

| +/-3 | 0.94% | 5.60** |

| +/-5 | 2.00% | 3.19** |

| +/-10 | 2.27% | -0.48 |

| 0/+1 | 0.18% | 0.23 |

| 0/+2 | 0.35% | 4.83** |

| 0/+3 | -0.02% | 4.48** |

| 0/+5 | -0.54% | 0.56 |

| 0/+10 | -0.75% | -2.16 |

| * significant at the 0.1 level; ** significant at the 0.05 level | ||

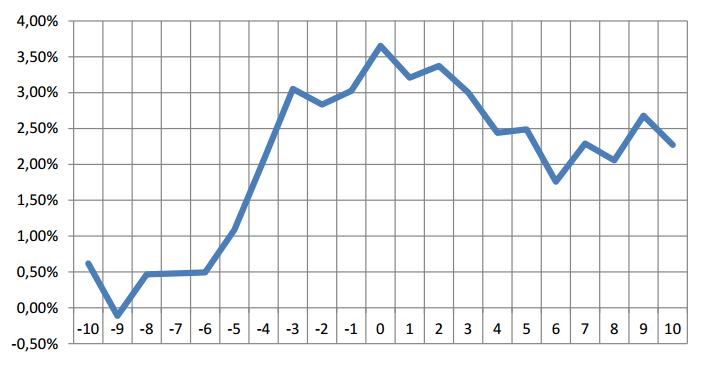

Figure 1 presents average cumulative abnormal returns from -10th to +10th day. The peak of cumulative abnormal returns averaged for all 34 announcements surpassing 3.5% occurs right in the event day. Results suggest that investors were able to anticipate to some extent future innovation announcements. They included new information in stock price valuation in periods preceding official announcement itself. This could be based on innovation preannouncements, related announcements, reports, financial reports, informal information etc. This kind of reaction refers to well known, old trading rule “buy the rumor, sell the fact”. The results are contrary to the Nicolau and Santa-Maria’s [2013] study that indicates a market value increase up to three days after the event.

Table 2 provides an overview of the short-term results disaggregated along innovation types; all of which follow a different pattern of stock price fluctuations. In most windows stock prices increased and among all the statistically significant results all were positive. Product and process innovation announcements produced the strongest investors’ reaction during the event day, while longer windows surrounding the event (+/-1, +/-2, +/-3, +/-5 and +/-10) were dominated by marketing, distribution and external relations ones. In the period following the event investors reacted the most to external relations innovation announcements, which produced statistically significant, positive returns in four windows (0/+2, 0/+3, 0/+5, 0/+10). The only innovation announcement type for which no statistically significant results in short term were observed is management one.

| Windows | ACARs | |||||

|---|---|---|---|---|---|---|

| PROD | PROC | MGMT | MKTK | DISTR | EXT REL | |

| Event day | 1.95%** | 1.62%* | 0.19% | 0.71% | -1.31% | 0.70% |

| +/-1 | 0.57% | 0.95% | -1.62% | 0.67%** | 0.71% | 0.95% |

| +/-2 | -1.45% | -1.39% | 0.35% | 1.18%* | 2.81%** | 0.78%** |

| +/-3 | -4.70% | -3.69% | 1.49% | 1.90%** | 7.09%** | 3.46%** |

| +/-5 | -5.57% | -2.71% | -2.51% | 2.19%* | 11.72%** | 7.54%** |

| +/-10 | -5.99% | -4.67% | 0.41% | -0.71% | 17.68%** | 4.77%** |

| 0/+1 | 0.63%* | 0.90% | -1.99% | 0.19% | -0.17% | 1.19% |

| 0/+2 | 0.01% | -0.28% | -0.63% | 1.95%* | -1.58% | 1.90%** |

| 0/+3 | -2.64% | -1.91% | -0.88% | 2.32%** | 6.45% | 2.53%** |

| 0/+5 | -4.11% | -2.43% | -3.46% | 0.61% | 12.55% | 3.67%** |

| 0/+10 | -6.01% | -4.28% | -4.12% | -3.15% | 7.35%** | 3.49%** |

| * significant at the 0.1 level; ** significant at the 0.05 level | ||||||

In order to test the differences between short-term abnormal returns resulting from innovation announcement of particular innovation types the one-way analysis of variance (ANOVA) followed by Games-Howell post hoc tests was employed. There was a statistically significant difference between groups as determined by one-way ANOVA (F(5,120) = 2.397, p < .05). Post hoc test indicated that distribution innovations (M = .0084, SD = .011) generate the mean excess return significantly higher than product innovations (M = -.0028, SD = .012) or process ones (M = -.0023, SD = .010). No significant differences between other innovation types were found. The data supports hypothesis 2.

Long-term innovations’ impact on tourism enterprises market value was proven to be positive. Average one-year cumulative abnormal return equaled 3.02%, meaning that the factual return in companies implementing innovations was 3.02% higher than the one predicted by Fama and French three-factor model. The result exceeds 0.77% one-year increase reported by Liu, Yeung, Lo and Cheng [2014] who studied the financial value of innovative technologies. The results suggest that investors’ reaction to innovation announcements in tourism companies spreads over the long period. The result is consistent with the research of Petrou i Daskalopoulou [2009] in which authors proved that innovation announcements influence the market value in the long term.

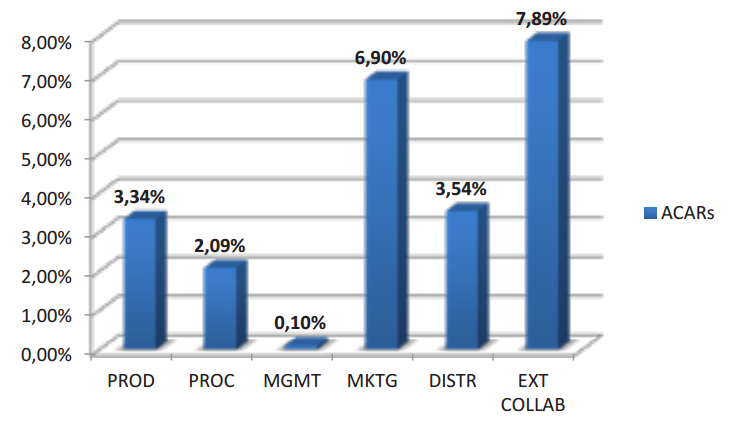

In order to verify the differences in investors’ reactions towards diverse innovation types, announcements were assigned to six separate portfolios. Consecutively within all portfolios abnormal returns were calculated. Figure 2 delivers average cumulative abnormal returns for the one-year period for six portfolios representing different innovation types.

All innovation types resulted in increase in company’s returns relative to Fama and French three-factor model. The strongest long-term investors’ reaction was caused by external relations innovations. One-years calendartime ACAR matched almost 8%. Marketing innovations for which ACARs reached almost 7% produced second strongest reaction. Distribution and product innovations’ effects were oscillating around the average for the whole population studied (3.02%) and equaled consecutively 3.54% and 3.34%. Investors responded the less to process innovations (2.09%) and management ones (0.10%).

Due to the fact that the whole surveyed population was divided into six categories, results can be biased by insufficient number of observations. As Sorescu, Shankar and Kushwaha (2007) state, reduced number of observations in portfolio causes a noteworthy loss of power in the empirical tests.

In order to verify whether different innovation types produced statistically significant differences in investors’ reactions, one-way ANOVA was performed. There was no statistically significant difference between groups (F(5,189) = 13.255, p > .05). These results uphold H3. Long-term innovation effects on market value differ from short term ones suggesting that investors adjust their initial reaction over time.

Conclusion

Due to a great level of uncertainty coming from growing competition and more and more demanding customers, tourism enterprises need to put more effort into developing and implementing innovations. Despite the growing interest in innovative practices in the tourism industry, relatively few studies to date have focused on the issue of financial effects of innovations. The main objective of this investigation was to examine the relationship between innovations and tourism enterprise market value in the short and long run. The results allow us to conclude that innovation announcements do convey information which is useful for the valuation of tourism firms and that, on average, in investors’ opinion the performance-enhancing factors related to innovation announced outweighed the performance-hindering factors.

Event study and calendar time portfolio approaches were employed to verify three initial hypotheses. The research showed that, on average, stock market investors judged that the expected gains stemming from innovations outweigh the expected costs. In their initial reaction investors seemed to perceive marketing, distribution and external relations innovations as the most beneficial, fewer recognized product and process ones while omitting management innovations. In the one-year period innovations implementation caused factual return to surpass the expected one. Simultaneously in the long term investors attributed the greatest value to external relations and marketing innovations and lower values to management and process ones. Product and distribution innovations caused market value rise close to average.

The findings have important implications for practice and research. First, the relation between the flow of information concerning innovations and share price was confirmed. Therefore effective company value management can rely on announcement policy. Second, innovations were confirmed to be a highly diversified category, as their different types produce different investors’ reactions. Third, results suggest the existence of leakage and dissemination effects, as share prices tend to rise in the period preceding the event day. Consequently the use of windows surrounding the event seems necessary. Fourthly, investors adjusted their initial reaction over time as their short-term valuation differed considerably from the long-term one. Thus research on innovations’ effects on tourism companies should consider longterm investors’ reactions.

The findings of this study should be considered in light of its limitations. The sample consisted only of 34 innovation announcements issued by 6 enterprises. It is regrettable that more data were not collected, as this would have facilitated a more rigorous analysis. Thus, replication using a larger sample would be beneficial. Data analysis was based on one typology of innovations. Other classification criteria could lead to interesting conclusions. Another important avenue for further research would be to conduct a more detailed analysis of variables moderating the strength of a relationship between innovations and tourism enterprise market value. It would be of value to examine the role of the type of economic activity, organizational characteristics and external factors play in the process of investors’ updating their expectations about future cash flows due to innovation implementation. Future research should seek for insights into these areas.

References

- Camisón, C., Monfort-Mir, V. (2012). Measuring Innovation in Tourism from the Schumpeterian and the Dynamic-Capabilities Perspectives. Tourism Management, 33(4), 776-789.

- Carlborg, P., Kindström, D. & Kowalkowski, C. (2014). The Evolution of Service Innovation Research: A Critical Review and Synthesis. Service Industries Journal, 34(5), 373-398.

- Ciborowski, R. (2003). Procesy innowacyjne w warunkach globalizacji. In: A., Bocian (ed.), Ekonomia, polityka, etyka. Białystok: Wydawnictwo Uniwersytetu w Białymstoku.

- Copeland, T., Koller, T. & Murrin, J. (1997). Wycena: mierzenie i kształtowanie wartości firmy. Warszawa: WIG-Press.

- Damanpour, F. (1996). Organizational Complexity and Innovation: Developing and Testing Multiple Contingency Models. Management Science, 42(5), 693-716.

- Fama, E. (1970). Efficient capital markets: a review of theory and empirical work. Journal of Finance, 25(2), 383–417.

- French, K. (2014). Data Library. Ratrieved from http://mba.tuck.dartmouth. edu/pages/faculty/ken.french/ data_library.html.

- Drejer, I. (2004). Identifying Innovation in Surveys of Services: A Schumpeterian Perspective. Research Policy, 33(3), 551-562.

- Eckbo, E. (ed.) (2007). Handbook of Corporate Finance. Volume 1. Amsterdam - Boston - Heidelberg: Elsevier.

- Fama, E., French, K. (2007). Disagreements, Tastes, and Asset Prices. Journal of Financial Economics, 83, 667-689.

- Geyskens, I., Gielens, K. & Dekimpe, M. (2002). The Market Valuation of Internet Channel Additions. Journal of Marketing, 66(2), 102-119.

- Grissemann, U., Plank, A. & Brunner-Sperdin, A. (2013). Enhancing Business Performance of Hotels: The Role of Innovation and Customer Orientation. International Journal of Hospitality Management, 33, 347-356.

- Gunday, G., Ulusoy, G., Kilic, K. & Alpkan, L. (2011). Effects of Innovation Types on Firm Performance. International Journal of Production Economics, 133(2), 662-676.

- Hall, C., Williams, A. (2008). Tourism and Innovation. London: Routledge.

- Hjalager, A. (2010). A Review of Innovation Research in Tourism. Tourism Management, 31(1), 1-12.

- Janasz, W., Kozioł, K. (2007). Determinanty działalności innowacyjnej przedsiębiorstw. Warszawa: PWE.

- Liu, X., Yeung, A., Lo C. & Cheng, T. (2014). The moderating effect of knowledge characteristics of firms on the financial value of innovative technology products. Journal of Operations Management, 32, 79-87.

- MacKinlay, A. (1997). Event Studies in Economics and Finance. Journal of Economic Literature, 35(1), 13-39.

- McWilliams, A., Siegel, D (1997). Event Studies in Management Research: Theoretical and Empirical Issues. Academy of Management Journal, 40(3), 626-657.

- Milburn, J. (2008). The Relationship Between Fair Value, Market Value, and Efficient Markets. Accounting Prespectives, 7(4), 293-316.

- Mitchell, M., Stafford, E. (2000). Managerial Decisions and Long- Term Stock Price Performance. Journal of Business, 73(3), 287-329.

- Nicolau, J., Santa-María, M. (2013). The Effect of Innovation on Hotel Market Value. International Journal of Hospitality Management, 32, 71-79.

- OECD, Eurostat. (2005). Oslo Manual: Guidelines for Collecting and Interpreting Innovation Data, 3rd Edition, The Measurement of Scientific and Technological Activities, OECD Publishing.

- Orfila-Sintes, F., Mattsson, J. (2009). Innovation Behavior in the Hotel Industry. Omega, 37(2), 380-394.

- Ottenbacher, M. (2007). Innovation Management in the Hospitality Industry: Different Strategies for Achieving Success. Journal of Hospitality & Tourism Research, 31(4), 431-454.

- Petrou, A., Daskalopoulou, I. (2009). Innovation and Small Firms’ Growth Prospects: Relational Proximity and Knowledge Dynamics in a Low-Tech Industry. European Planning Studies, 17(11), 1591-1604.

- Pikkemaat, B., Peters, M. (2005). Towards the Measurement of Innovation – A Pilot Study in the Small and Medium Sized Hotel Industry. Journal of Quality Assurance in Hospitality & Tourism, 6(3/4), 89-112.

- Rappaport, A. (1998). Creating Shareholder Value: A Guide for Managers and Investors. New York: The Free Press.

- Saunila, M., Ukko, J. (2012). A Conceptual Framework for the Measurement of Innovation Capability and Its Effects. Baltic Journal of Management, 7(4), 355-375.

- Seasholes, M., Zhu, N. (2010). Individual Investors and Local Bias. The Journal of Finance, LXV(5), 1987-2010.

- Siguaw, J., Enz, C., Kimes, S., Verma, R. & Walsh, K. (2009). Cases in Innovative Practices in Hospitality and Related Services. Cornell Hospitality Report, 9(17).

- Sood, A., Tellis, G. (2009). Do Innovations Really Pay Off? Total Stock Market Returns on Innovation. Marketing Science, 28(3), 442-456

- Sorescu, A., Shankar, V. & Kushwaha, T. (2007). New Products Preannouncements and Shareholder Value: Don’t Make Promises You Can’t Keep. Journal of Marketing Research, XLIV(August), 468-489.

- Szablewski, A., Tuzimka, R. (eds.) (2004). Wycena i zarządzanie wartością firmy. Warszawa: Poltext.

- Szczepankowski, P. (2007). Wycena i zarządzanie wartością przedsiębiorstwa. Warszawa: Wydawnictwo Naukowe PWN.

- Szutowski, D. (2014). Unification of Capital Markets. Example of Tourism Companies. Retrieved from http://gisap.eu/node/41350

- Szyszka, A. (2003). Efektywność giełdy papierów wartościowych w Warszawie na tle rynków dojrzałych. Poznań: Wydawnictwo Akademii Ekonomicznej w Poznaniu.

- Weiermair, K. (2004). Product Improvement or Innovation: What is the Key to Success in Tourism. In: Innovation and Growth in Tourism Conference, September 18-19, Lugano, Switzerland, Retrieved from http://www. oecd.org/cfe/tourism/34267947.pdf.

- Wilimowska, Z. (2008). Struktura kapitałowa w koncepcji zarządzania przez wartość. In T. Duducz (ed.), Wartość jako kryterium efektywności. Wrocław: Indygo Zahir Media.

- Williams, A., Shaw, G. (2011). Internationalization and Innovation in Tourism. Annals of Tourism Research, 38(1), 27-51.

- WTTC. (2014). Travel & Tourism. Economic Impact 2014. European Union, Retrieved from http://www.wttc.org/site_media/uploads/downloads/ european_union2014.pdf.

Biographical notes

Dawid Szutowski is a PhD Candidate at the Department of Tourism, Faculty of International Business and Economics, Poznan University of Economics, Poland. His areas of research include innovations in tourism, finances in tourism and tourism enterprises’ position on European capital markets.

Marlena a. Bednarska, PhD in Economics is an assistant professor at the Department of Tourism, Faculty of International Business and Economics, Poznan University of Economics, Poland. Her areas of research include tourism industry competitiveness, entrepreneurship and innovation in tourism, tourism labor market, and quality of work life in tourism.